Introduction

Car insurance is an essential expense for anyone who owns a vehicle, but it can be a significant financial burden for some. Fortunately, there are ways to lower the cost of car insurance without sacrificing quality coverage. One of the most effective strategies is to find a cheap car insurance policy that fits your budget. However, with so many options available, it can be challenging to determine what to look for in a cheap car insurance policy. In this blog, we’ll explore the factors to consider when choosing a cheap car insurance policy and provide tips to help you find the right coverage to fit your financial needs. So why pay more than necessary for coverage when affordable car insurance is within reach? Keep reading to learn where to find cheap car insurance and how to make sure you’re getting the most bang for your buck.

Car For Cheap Insurance: Understanding the Idea of Affordable Insurance Cars

Are you tired of paying high insurance premiums for your vehicles, including your Honda Accord and SUVs? Do you want to find an insurer like Geico that provides coverage at a reasonable price? If so, you’re not alone. Affordable car insurance is essential for all drivers, but it can be challenging to find the right insurer that meets your needs and budget.

Car For Cheap Insurance

Car for cheap insurance typically refers to policies with lower premiums or rates. Premiums are the amount of money you pay your insurer each month or year in exchange for coverage. The cost of your premium depends on several factors, including your driving record, age, gender, location, and the type of vehicle you drive. SUVs are usually more expensive to insure than average vehicles due to their higher risk of accidents and theft.

How Much Is Insurance For A Cheap Car?

The cost of insurance for a cheap vehicle or SUV will depend on several factors, including your driving record, age, gender, location, and the type of vehicle you drive. Generally speaking, however, choosing an average car with a high safety rating and low repair costs can help lower your premiums.

To get an accurate quote for your specific situation and insurance cost, it’s best to shop around and compare rates from multiple insurers. You can look for cheap auto insurance that still offers good insurance coverage by checking with the insurance institute.

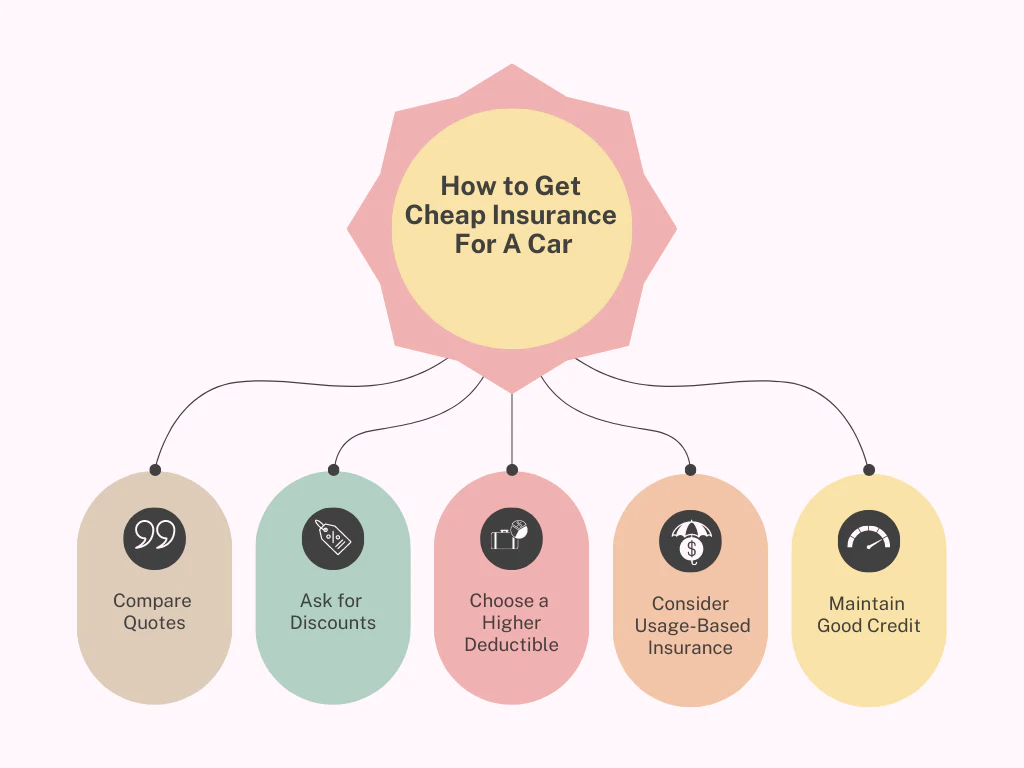

How to Get Cheap Insurance For A Car

There are multiple ways to find cheap insurance for your car. Here are some ways you can consider:

1. Compare Quotes: Comparing insurance quotes from multiple providers is the most effective way to find cheaper car insurance. You can start by using online comparison tools to get quotes from reputable insurers that offer cheap car insurance policies.

2. Ask for Discounts: Many car insurance providers offer discounts for various reasons, such as having a good driving record, bundling insurance policies, or installing safety devices on your car. You can ask your insurer about all the discounts you could be eligible for.

3. Choose a Higher Deductible: Selecting a higher deductible could reduce your car insurance premiums. A higher deductible means you’ll be responsible for paying more out-of-pocket for damages incurred in an accident, but it will lower your monthly insurance costs.

4. Consider Usage-Based Insurance: Some insurance companies now offer usage-based insurance, which uses a device installed in your car to monitor your driving habits. If you’re a responsible driver, you could benefit from lower insurance rates.

5. Maintain Good Credit: In some states, your credit score can affect your car insurance premiums. By maintaining a good credit score, you could potentially save money on your insurance policy.

Factors That Affect Car Insurance Rates and How to Lower Them

Car insurance rates can vary significantly depending on several factors, ultimately affecting the average cost. Some of these factors are beyond our control, such as age, gender, and location. However, there are ways to lower car insurance rates by taking advantage of the factors that we can control.

Factors That Impact Car Insurance Rates

Age: Younger drivers typically pay higher insurance premiums due to their high-risk status resulting from their lack of experience on the road. On average, drivers over 25 years old usually see a decrease in their insurance costs.

Driving Record: Your driving record is one of the most significant factors impacting your car insurance rates. If you have a history of accidents or traffic violations, your premiums will be higher than those with clean driving records.

Location: Where you live also affects your car insurance rates. Highly populated areas with more traffic and crime tend to have higher premiums than rural areas.

Type of Car: The type of car you drive has a significant impact on your insurance premium levels. Sports cars and luxury vehicles often come with higher premiums than standard sedans or family cars.

Credit Score: In most states, credit score is another factor that impacts your car insurance rate since it’s believed that people with good credit scores are more responsible drivers.

Ways to Lower Car Insurance Rates

1. Increase Your Deductible: Increasing your deductible can help lower your monthly auto insurance rate payments; however, this means you’ll have to pay more out-of-pocket if an accident occurs. To compare car insurance costs, check with the Insurance Institute for more information.

2. Bundle Policies: Bundling policies such as home and auto can lead to discounts from insurers resulting in lower overall costs for both policies. If you compare car insurance rates, bundling policies could be a great way to save money on your insurance.

3. Defensive Driving Courses: Completing defensive driving courses shows auto insurance providers that you’re committed to being a safe driver which may lead to lower rates for some insurers.

4. Maintaining a good credit score can lead to lower auto insurance rates as it shows insurers that you’re responsible and less likely to file a claim.

5. Choose the Right Car: When choosing a car, consider the insurance rates for each model. Cars with high safety ratings and low theft rates usually have lower premiums than sports cars or luxury vehicles.

Tips for Getting the Best Car Insurance Deal

Look for Discounts on Car Insurance Policies

One of the best ways to get a cheap car insurance deal is by looking for discounts. Many insurance companies offer various discounts that can help reduce your premiums. Here are some common discounts you should look out for:

• Good driver discount: If you have a good driving record with no accidents or violations, you may be eligible for this discount.

• Multi-car discount: If you insure multiple cars under the same policy, you may qualify for this discount.

• Bundling discount: If you bundle your car insurance with other types of insurance such as home or life insurance, you could receive a discount on all policies.

• Low mileage discount: If you drive less than a certain number of miles per year, usually around 10,000 miles, you may be eligible for this discount.

Compare Offers from Different Insurance Providers

It’s important to shop around and compare offers from different insurance providers to find the best deal. Don’t just settle for the first quote you receive. Take your time to research and compare rates from several providers before making a decision.

When comparing offers, make sure to consider factors beyond just price. Look at coverage limits, deductibles, and any additional benefits offered by each provider. Also, check customer reviews and ratings to see how satisfied other customers are with their service.

Choose the Best Coverage That Suits Your Needs

While it’s important to get a cheap car insurance deal, it’s equally important to choose coverage that suits your needs. The cheapest policy may not always provide adequate coverage in case of an accident or other unexpected events.

Make sure to assess your needs carefully before choosing a policy. Consider factors such as your driving habits, the value of your car, and any potential risks involved in driving in your area.

Take Advantage of Special Offers and Promotions

Insurance companies often run special offers and promotions that can help you save money on your car insurance. Keep an eye out for these offers and take advantage of them when they become available.

Some common promotions include:

• New customer discounts: Many providers offer special discounts to new customers who sign up for a policy.

• Referral bonuses: Some providers offer bonuses or discounts to customers who refer friends or family members to their service.

• Safe driving programs: Some providers offer programs that reward safe driving habits with lower premiums.

Consider Bundling Your Car Insurance with Other Types of Insurance

Bundling your car insurance with other types of insurance such as home or life insurance can help you save money on all policies. Many providers offer discounts for bundling, so make sure to check if this option is available to you.

Bundling also has the added benefit of simplifying your insurance management. You’ll only have one provider to deal with, making it easier to keep track of payments and renewals.

The Benefits of Having a Good Credit Score for Car Insurance Rates

Many factors come into play. One of the most important factors that insurance companies consider is your credit score. A good credit score can help you get lower rates on your car insurance.

Lower Car Insurance Rates

Insurance companies use credit scores to determine the likelihood of filing a claim. They have found that people with higher credit scores are less likely to file claims than those with lower credit scores. As a result, they offer lower rates to those with better credit scores.

Having a good driving record and a good credit score can lead to significant savings on car insurance. For example, if you have a clean driving record and an excellent credit score, you could save up to 50% on your car insurance premiums.

How Credit Scores Affect Car Insurance Rates

Your credit score is used by insurers as an indicator of how responsible you are as a driver and how likely you are to file a claim in the future. Insurance companies believe that individuals who have poor credit scores are more likely to file claims due to their financial difficulties.

Some states allow insurers to use your credit history when determining your car insurance rates. Insurers in these states may look at your payment history, outstanding debt, length of credit history and new applications for loans or other forms of financing.

Improving Your Credit Score

Improving your credit score is one way that you can save money on your car insurance premiums. Some ways that you can improve your score include:

1. Paying bills on time: Late payments can negatively impact your score.

2. Reducing debt: High levels of debt can also hurt your score.

3. Checking for errors: Make sure there aren’t any errors on your report that could be dragging your score down.

4. Limiting new applications for credit: Too many applications can hurt your score.

The Role of Car Safety Features in Reducing Insurance Costs

If you’re looking for a car that will save you money on insurance, safety features should be at the top of your list. Not only do they help keep you and your passengers safe, but they can also significantly reduce the risk of accidents and injuries, leading to lower insurance costs.

Safety Features Can Help Prevent Collisions

One of the most significant benefits of safety features is their ability to prevent collisions. For example, cars equipped with electronic stability control (ESC) can help drivers maintain control in emergency situations, reducing the likelihood of a crash. Anti-lock brakes (ABS) can also help prevent collisions by allowing drivers to brake quickly without skidding.

Lower Repair Costs Mean Lower Insurance Premiums

In addition to preventing collisions, safety features can also reduce repair costs if an accident does occur. For example, airbags can significantly reduce the risk of serious injury or death in a crash, which means less damage to the vehicle and lower repair costs.

Advanced Safety Features Can Reduce Liability Claims

According to research from the Highway Loss Data Institute (HLDI), cars with advanced safety features have lower injury liability and bodily injury claims than those without these features. This is because these features are designed to mitigate the severity of accidents when they do occur.

Discounts May Be Available for Cars with Safety Features

Many insurance companies offer discounts for cars equipped with certain safety features. For example, some insurers may offer a discount for vehicles with anti-theft devices or lane departure warning systems. These discounts can make it easier for drivers to afford liability coverage while still enjoying all the benefits that come with having a safe car.

There are many factors that come into play. However, one thing is clear: Investing in a vehicle with advanced safety features is one of the best ways to reduce your overall insurance costs. By preventing collisions, reducing repair costs, and lowering liability claims, these features can help you save money while keeping you and your passengers safe on the road.

Finding the Right Car and Insurance Policy for Your Budget

Choose a Car Model with Safety Features and Low Insurance Rates

When looking to purchase a car, it’s important to consider both its safety features and insurance rates. Certain car models are known for their safety ratings, which can help lower your insurance costs. The National Highway Traffic Safety Administration (NHTSA) provides crash test ratings for most vehicles on the market, so be sure to check these before making a purchase.

Some cars have lower insurance rates than others due to factors such as their size, repair costs, and likelihood of theft. According to Insure.com’s annual ranking of the cheapest cars to insure in 2023, some of the top models include the Honda CR-V LX, Hyundai Venue SE, and Subaru Forester 2.5I Wilderness.

Consider Purchasing a Used Car Instead of New

One way to save money on both your car purchase and insurance costs is by opting for a used vehicle instead of buying a new one. Used cars generally have lower values than new ones, which means that insurance premiums will also be lower.

However, it’s important to note that older cars may not have all of the latest safety features or technology that newer models do. Be sure to research specific makes and models before making a decision.

Compare Insurance Policies from Different Providers

Insurance policies can vary widely in terms of coverage options and cost. To make sure you’re getting the best deal possible for your budget, it’s important to make comparable car insurance policies from different providers.

Consider factors such as deductibles, coverage limits, and additional services offered by each provider. Look into each company’s financial strength and customer service reputation before making a final decision.

Opt for Liability Coverage Instead of Full Coverage

If you have an older vehicle or one with a lower value, it may make sense to opt for liability coverage instead of full coverage. Liability coverage only covers damages or injuries you cause to others in an accident, while full coverage also includes protection for your own vehicle.

While full coverage may provide additional peace of mind, it can come with higher premiums. Consider your specific needs and budget when deciding which type of coverage to choose.

Comparing Car Insurance Quotes for Your Budget

Why Compare Car Insurance Quotes?

Car insurance is a necessary expense for any driver, but finding affordable coverage that meets your needs can be a challenge. This is where comparing car insurance quotes comes in handy. By shopping around and getting quote for a car insurance from different providers, you can find the best coverage for your budget.

Is Cheap Auto Insurance Always the Best Option?

While it may be tempting to opt for the cheapest auto insurance policy available, it’s important to consider whether it provides adequate coverage for your needs. Cheaper policies may have higher deductibles or lower limits on certain coverages, which could leave you vulnerable in the event of an accident.

How Can You Compare Car Insurance Quotes?

To compare car insurance quotes, follow these steps:

1. Determine what type of coverage you need: Consider factors such as how often you drive, where you live, and what type of vehicle you own.

2. Gather information about yourself and your vehicle: This includes details such as your age, driving history, and make and model of your car.

3. Research different providers: Look at reviews and ratings from other customers to get an idea of each company’s reputation.

4. Get quotes from multiple providers: Use online comparison tools or contact each provider directly to get personalized quotes based on your specific needs.

5. Compare costs and coverages: Review each quote carefully to determine which provider offers the best value for your budget.

What Are Some Insurance Companies That Offer Competitive Quotes?

Some insurance companies that offer competitive car insurance quotes include:

• Geico

• Progressive

• State Farm

• Allstate

Keep in mind that the cost of your insurance will depend on several factors unique to you, so it’s important to get personalized quotes from each provider.

Conclusion

Finding car insurance that fits your budget can be challenging. Understanding the factors that affect car insurance rates and how to lower them is crucial to getting the best deal. Having a good credit score and choosing a safe car with advanced safety features can also help reduce insurance costs. Comparing quotes from different providers is essential in finding the right policy for your budget. Remember to always prioritize safety when choosing a car and don’t sacrifice coverage for cost. It’s important to meet state minimum requirements, but it’s also important to have adequate coverage in case of an accident. We hope this guide has helped you understand more about car insurance rates and how to find affordable options that fit your needs.

Frequently Linked Pages

1. Insurance The Car: A Beginner’s Guide to Unravelling the Complexities of Car Insurance

2. Quote for a Car Insurance: How to Use Your Car Insurance Quote to Get the Best Coverage Possible

3. Comparable Car Insurance 2023: Finding the Best Policy for Your Pocket

4. Cheapest Car Insurance in California: A Guide to Securing Affordable Car Insurance in California

5. Car Insurance Cheap in Florida: Protecting Yourself and Your Vehicle

Frequently Asked Questions

1. What are some common factors that influence car insurance rates?

Car insurance rates are influenced by several factors such as age, driving record, location, type of vehicle, coverage level, and credit score.

2. How can I lower my car insurance rates?

You can lower your car insurance rates by maintaining a good driving record, choosing a safe vehicle with advanced safety features, bundling policies, increasing deductibles, and qualifying for discounts such as good student or low mileage discounts.

3. Is it necessary to have comprehensive coverage?

Comprehensive coverage is not required by law but may be necessary depending on the value of your vehicle and personal preferences. Comprehensive coverage protects against theft or damage caused by events other than collisions such as natural disasters or vandalism.

4. Can I change my policy if I find a better deal elsewhere?

Yes, you can switch providers at any time if you find a better deal elsewhere. However, make sure to check for cancellation fees or penalties before making the switch.

5. How often should I review my policy?

It’s recommended to review your policy annually or whenever there are significant changes in your life such as moving or purchasing a new vehicle. This ensures that your coverage is up to date and meets your current needs.