Introduction

Are you tired of paying high premiums for your car insurance? Did you know that comparing policies from different companies, such as Geico, can save you hundreds of dollars per year? That’s where comparable car insurance comes in. The idea behind it is simple: by reviewing and comparing coverages, terms, details, and pricing from multiple insurers, you can find personalized rates and discounts for the best policy to fit your needs and budget.

Comparable Car Insurance in 2023

Comparing car insurance policies from different auto insurers has several advantages. First, it allows you to see what coverages each company offers and choose the one that suits you best. Second, it helps you avoid surprises in case of an incident or crash. By doing your research and shopping around for pricing, however, you can find full coverage rates that fit your needs without breaking the bank.

Standardized Car Insurance Requirements

Starting in 2023, auto insurers will need to provide more standardized coverages for both minimum and full coverage rates across different states. This is due to the implementation of a new federal law that aims to simplify the process of obtaining car insurance and increase transparency for consumers.

This means that drivers will have a better understanding of what their auto insurance policy covers and what it doesn’t, regardless of which provider they choose. The new standardized requirements will also make it easier for drivers to compare auto insurance rates and auto insurance quotes from different providers. Additionally, the comprehensive insurance coverage will be more clearly defined under the new requirements.

Comparable Car Insurance

One of the benefits of standardized car insurance requirements is that it will be easier to obtain comparable car insurance quotes from different providers such as Geico. This means that consumers can easily compare coverages and full coverage rates side-by-side and select the personalized rates that best fit their needs and budget.

Comparable auto insurance, including coverages from providers like Geico and USAA, will also provide greater transparency and clarity when selecting a policy. Drivers can be confident that they are getting an apples-to-apples comparison between different providers, making it easier to identify any differences in coverage or pricing.

Technology Simplifying the Process

Advancements in technology have made obtaining comparable car insurance quotes even simpler. Many providers now offer online tools that allow drivers to quickly input their information and receive personalized quotes within minutes. These tools not only help you compare full coverage rates but also help you find the best coverages from top insurers like Geico and USAA.

These tools often use algorithms to take into account factors such as age, driving history, location, and type of vehicle when generating quotes for auto insurance rates. This makes it easy for drivers to get accurate estimates of average car insurance rates and car insurance costs without having to spend hours on the phone with different providers or filling out lengthy forms. With this information, drivers can compare prices and choose the best auto insurance policy for their needs.

When does comprehensive insurance cover?

Comprehensive insurance coverages are designed to protect your vehicle from damages caused by theft, vandalism, natural disasters, falling objects, and crashes with animals. Full coverage rates can be obtained from insurance providers like Geico. This type of insurance also covers damage done to your vehicle outside of accidents with other cars.

When should I use comprehensive car insurance?

You should consider full coverage rates for comprehensive car insurance if you want protection against damage caused by non-collision incidents such as theft or natural disasters. This type of policy can also cover you in case of a crash and is offered by companies like State Farm for drivers who want complete peace of mind.

What does comprehensive car insurance cover?

Full coverage comprehensive car insurance covers damage to your vehicle caused by incidents outside of accidents with other cars. This includes theft, vandalism, natural disasters, falling objects, and collisions with animals. Drivers with good credit can get a quote to see how much their coverage will cost.

When is comprehensive insurance not worth it?

Comprehensive insurance quotes may not be worth it for average drivers with low credit, or if you have a high deductible that would make filing a claim financially impractical. It’s important to weigh the cost of the coverage against the potential benefits before deciding whether or not to purchase it.

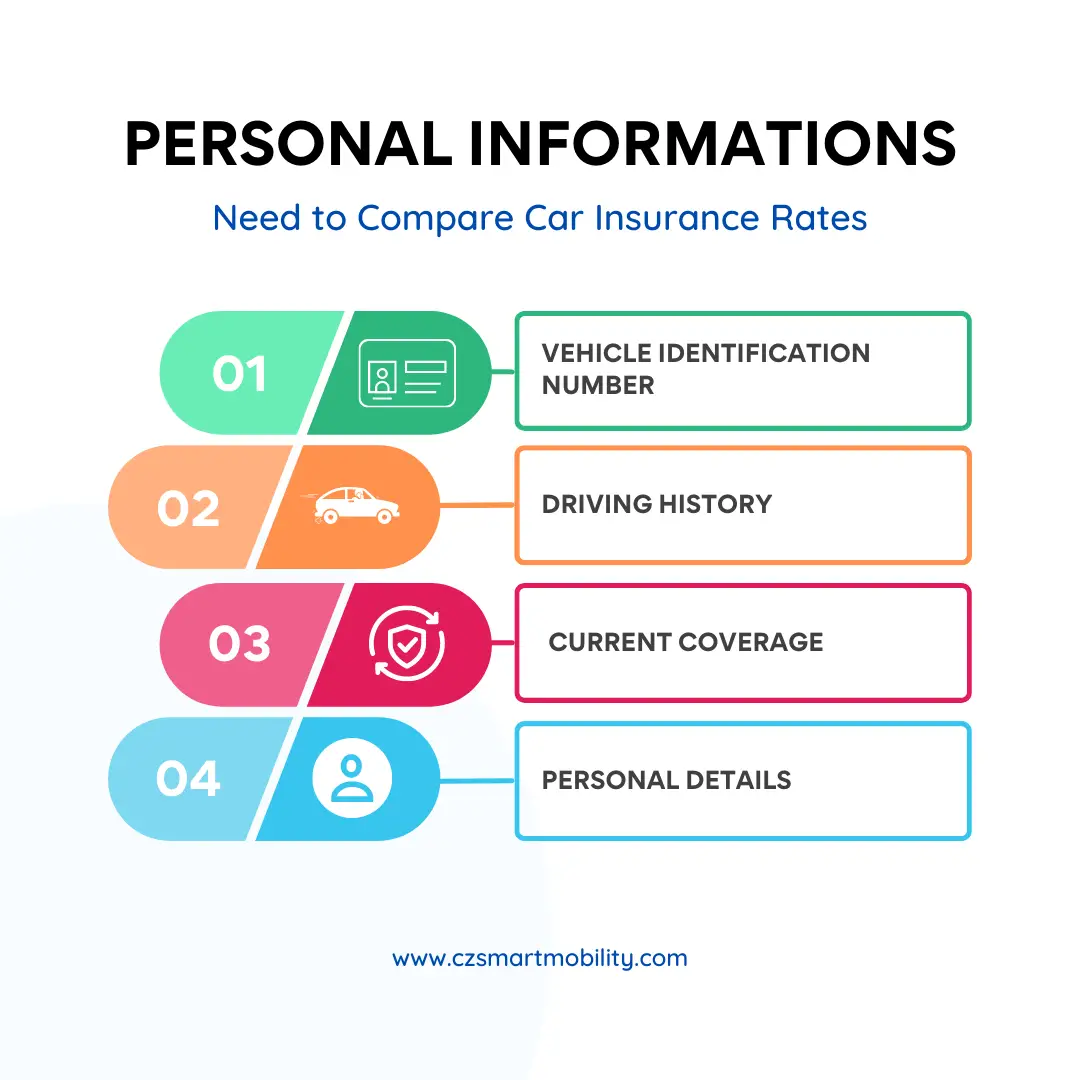

Gather Your Personal Info: What Information Do I Need to Compare Car Insurance Rates?

Gathering your personal information is crucial when shopping for auto insurance. Having all the necessary details ready before comparing comprehensive insurance quotes can make the process of finding full coverage smoother and faster. It’s important to have an idea of average car insurance rates in order to make an informed decision.

Vehicle Identification Number (VIN)

The vehicle identification number (VIN) is a unique 17-digit code assigned to every vehicle manufactured after 1981. It contains valuable information about the car’s make, model, year of manufacture, and other specifications that help drivers and insurance companies determine its value and risk level. This information is essential for obtaining accurate auto insurance quotes, as well as assessing the creditworthiness of the driver.

Your VIN is an essential piece of information for drivers seeking car insurance rates. It provides insurers with accurate data about your vehicle, including its average year and credit history. This means that if you provide an incorrect or incomplete VIN, you may receive inaccurate quotes that do not reflect your actual coverage needs.

Driving History

Your driving history and credit score are both important factors that insurers consider when determining your car insurance rates. Drivers with good credit scores may be eligible for lower premiums, especially if they opt for full coverage. To get an accurate quote, it’s important to provide your complete driving and credit history to the insurer.

Some of the factors that influence your driving history, and ultimately your auto insurance rates, include drivers on your policy, your credit score, and your past claims. It’s important to note that these factors are taken into consideration when getting a car insurance quote.

1. Accidents: If you have been involved in auto accidents in the past, especially those that were deemed your fault, expect higher insurance premiums when requesting an insurance quote for full coverage. The average cost of auto insurance may also increase due to these accidents.

2. Tickets for traffic violations, such as speeding or DUIs, can increase insurance rates for drivers with full coverage, on average, every year.

3. Claims: Filing claims for damages or injuries sustained while driving can also affect the auto insurance premiums of drivers with full coverage, which is the average coverage among drivers.

Make sure to gather all relevant information about your driving history before comparing car insurance rates for full coverage. This includes any accidents, tickets, or claims filed by drivers within the last five years on average.

Current Coverage

If you’re like most drivers and already have car insurance coverage, it’s essential to know what type of policy you have and how much coverage you currently carry on average each year. This helps ensure that you’re comparing apples to apples when shopping for new quotes.

Some of the coverage types to consider include:

• Auto insurance liability: Covers damages and injuries drivers cause to others in an accident. Full coverage is available year-round.

• Collision: Provides full coverage for damages to your vehicle if you, as a driver, are involved in a collision, regardless of the year or average condition of your car.

• Comprehensive coverage protects drivers from non-collision-related damages such as theft, vandalism, or natural disasters that can occur on average every year.

Knowing your average current coverage levels as driver can help you identify areas where you may need additional protection or where you can reduce coverage to save money year after year.

Personal Details

Finally, make sure to have all your personal details on hand when comparing car insurance rates. This includes your name, address, date of birth, driver’s license number, and average number of miles driven per year. Insurers use this information to verify your identity and calculate accurate quotes based on factors such as location, age, and driving habits.

Compare Car Insurance Rates by State, Company, and Coverage Type

Car insurance rates can vary greatly depending on the state you live in, the company you choose, and the coverage types you select. Understanding these differences is crucial to finding the average car insurance rates for drivers each year that best suits your needs.

Comparing Car Insurance Rates by State

One of the primary factors that affect car insurance rates is the state you live in. Each state has its own set of laws and regulations that impact how much drivers pay for car insurance. For example, states with high population densities may have higher rates due to the average increased risk of accidents and theft.

To compare car insurance rates by state, start by researching your state’s minimum coverage requirements. Then, look at average rates for drivers in your area. You can find this information online or through a local insurance agent.

Comparing Car Insurance Rates by Company

Another important factor to consider when comparing car insurance rates is the company you choose. Different companies offer different policy options and discounts that can impact your overall rate. It’s worth noting that drivers with an average driving record may receive different rates from each company.

One popular option is State Farm, which offers competitive policy rates for car insurance coverage. However, it’s important to research multiple companies before making a decision. Look at customer reviews and ratings to get an idea of each company’s reputation and level of service.

Understanding Different Coverage Types

The type of coverage you select also plays a significant role in determining your average car insurance rate. Some common coverage types include liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection (PIP), and roadside assistance.

Liability coverage is typically required by law and covers damages or injuries caused to others in an accident where you are at fault. Collision coverage pays for damage to your own vehicle in an accident regardless of fault. Comprehensive coverage protects against non-collision incidents such as theft or natural disasters. On average, these coverages provide financial protection for drivers.

Uninsured/underinsured motorist coverage provides protection if you are involved in an accident with a driver who does not have sufficient insurance. PIP coverage covers average medical expenses for you and your passengers in the event of an accident. Roadside assistance provides help if you break down or have other average car-related issues while on the road.

National Rates vs. State-Specific Rates

It’s important to note that average national rates for car insurance coverage can differ from state to state. This is due to a variety of factors, including state laws and regulations, population density, and weather patterns.

For instance, states with an average of high rates of severe weather may have higher comprehensive coverage rates than states with an average of milder climates. Similarly, states with an average of high populations may have higher liability coverage rates due to the increased risk of accidents.

How to Choose the Right Coverage Types

Choosing the right coverage types can be overwhelming, but understanding your options is key. Start by researching your state’s minimum coverage requirements and then determine what additional coverages make sense for your average needs.

Consider factors such as your average driving habits, the value of your average vehicle, and any potential average risks in your area when selecting coverages. You may also want to consider bundling policies or taking advantage of average discounts offered by certain companies.

Offer a Side-by-Side Comparison of Different Car Insurance Quotes

If you’re looking for car insurance, it can be overwhelming to compare all the different options available to you. With so many insurers and coverage options, it’s hard to know which policy is right for your needs. That’s why offering a side-by-side comparison of average different car insurance quotes is essential.

How to Compare Car Insurance Quotes

There are several ways to compare average car insurance quotes. One option is to use online tools that allow you to enter your information and receive quotes from multiple auto insurers. These tools make it easy to compare rates and coverage options side by side. Some popular online resources include:

• NerdWallet

• The Zebra

• Compare.com

• Insurify

• Policygenius

Another way to compare car insurance quotes is by working with an insurance agent who can provide personalized recommendations based on your specific needs and budget. They can also help you navigate the complex world of car insurance and find the right insurer for you, taking into account the average rates in the market.

Comparable Car Insurance Quotes

When comparing car insurance quotes, it’s important to ensure that you’re comparing comparable policies. This means looking at factors such as the average cost of the policies.

1. Coverage limits: Make sure that each quote provides the same average level of protection.

2. Deductibles: Ensure that the deductibles are consistent across all policies.

3. Discounts: Consider any discounts that may apply, such as safe driver or multi-policy discounts.

4. Additional coverage: Look at any additional coverage options offered by each insurer, such as comprehensive coverage or roadside assistance.

By comparing comparable policies, you’ll be able to make an informed decision about which policy offers the best value for your money.

Where to Compare Car Insurance Quotes

As mentioned earlier, there are several online tools available for comparing car insurance quotes. However, it’s important to do your research before choosing a tool or website. Look for sites that are reputable and have good customer reviews. Be sure to read the fine print and understand any fees or limitations associated with using the site.

If you prefer to work with an insurance agent, start by asking for recommendations from friends and family. You can also search for agents in your area online or through professional organizations such as the National Association of Insurance Commissioners.

Comparing car insurance quotes may seem like a daunting task, but it’s essential if you want to find the right policy for your needs. By using online tools or working with an insurance agent, you can easily compare rates and coverage options from multiple insurers. Just be sure to compare comparable policies and do your research before making a decision. With a little time and effort, you’ll be able to find the best auto insurance policy for your needs.

Choose Deductibles and Review Liability Limits

There are a lot of factors to consider. One of the most important is selecting deductibles and liability limits that work for your budget and needs. Here’s what you need to know about these two critical components of your policy.

Choose deductibles wisely

Your deductible is the amount you’ll pay out-of-pocket before your insurance kicks in after an accident. A higher deductible typically means a lower premium, but it also means you’ll have to pay more if you get into an accident. Conversely, a lower deductible will give you more coverage upfront but will increase your monthly premiums.

When deciding on a deductible amount, think about how much money you could afford to pay out-of-pocket in the event of an accident. If you have enough savings or can quickly access funds, consider raising your deductible to save money on monthly premiums. However, if paying a high out-of-pocket cost would be difficult for you financially, opt for a lower deductible instead.

It’s also worth noting that some insurance companies offer partial refunds if you don’t file any claims over time. This can be an excellent way to save money on your policy while still having adequate coverage.

Review minimum liability coverage limits

Liability insurance covers medical bills and injury liability for the other driver and passengers if you’re at fault in an accident. It’s essential to review the minimum liability coverage limits required by law in your state and compare them with how much protection you want for yourself.

Consider raising your liability coverage levels beyond what’s required by law so that all parties involved are adequately protected in case of an insurance claim. This is particularly important if you have assets that could be seized to pay for damages in a lawsuit.

Liberty Mutual can help

Choosing the right deductibles and liability coverage limits can be challenging, but Liberty Mutual is here to help. They offer customizable policies designed to fit your unique needs and budget, so you can feel confident that you’re getting the protection you need without overpaying.

Average Monthly Full Coverage Car Insurance Rates by Credit Score

Your credit score can have a significant impact on your car insurance rates. In fact, it’s one of the most crucial factors that insurance companies consider when determining how much you’ll pay for coverage. So, what are the average monthly full coverage car insurance rates by credit score? Here’s everything you need to know.

How do Credit Scores Affect Car Insurance Rates?

Insurance companies use credit scores as a way to predict how likely someone is to file a claim. They believe that people with higher credit scores are more responsible and less likely to get into accidents or make claims. On the other hand, individuals with lower credit scores may be seen as riskier and more likely to file claims.

Improving Your Credit Score

If you’re looking to save money on car insurance, improving your credit score is one way to do it. Here are some tips for boosting your score:

1. Pay all bills on time: Late payments can hurt your credit score.

2. Keep balances low: Try not to use too much of your available credit.

3. Check your report for errors: Mistakes can bring down your score.

4. Don’t open too many new accounts at once: This can lower your average account age.

5. Keep old accounts open: A long credit history can boost your score.

Minimum Car Insurance Requirements

Remember that these rates are for full coverage car insurance, which includes liability, collision, and comprehensive coverage. Your state may have different minimum requirements for car insurance. Make sure you know what the minimums are in your state so that you’re meeting legal requirements.

Why Insurance Companies Total Cars

Finally, let’s answer the question of why insurance companies total cars. When a car is damaged, the cost to repair it can sometimes be more than the value of the car itself. In these cases, the insurance company may decide to “total” the car and pay out its actual cash value instead of repairing it. This is usually a more cost-effective solution for both parties.

Compare Car Insurance Rates for Senior Drivers, Teen Drivers, and After an At-Fault Accident

Car insurance rates can vary significantly depending on various factors such as age, driving experience, and accident history.

Senior Drivers

Senior drivers are usually considered to be those over the age of 65. While they may have years of driving experience under their belt, they may also have certain health issues that could affect their ability to drive safely. As a result, car insurance rates for senior drivers may be higher than those for younger drivers.

Insurance companies often consider seniors to be more high-risk due to factors such as slower reflexes and deteriorating eyesight. However, there are still ways for seniors to save money on their car insurance premiums. For example:

• Taking a defensive driving course: Many insurers offer discounts to seniors who complete a defensive driving course.

• Bundling policies: Seniors who bundle their home and auto insurance policies with the same insurer may be eligible for additional discounts.

• Choosing a safe vehicle: Seniors who choose vehicles with safety features such as anti-lock brakes and airbags may qualify for lower premiums.

Teen Drivers

Teen drivers are often charged more for car insurance due to their lack of experience behind the wheel. According to the CDC (Centers for Disease Control), motor vehicle crashes are the leading cause of death among teens in the United States.

To offset the risk associated with insuring teen drivers, many insurers charge higher premiums. However, there are steps parents can take to help reduce these costs:

1. Good grades: Some insurers offer discounts to teen drivers who maintain good grades in school.

2. Safe driving programs: Many insurers offer discounts if teen drivers complete safe driving programs or courses.

3. Choose a safe vehicle: Parents should encourage their teens to drive vehicles with safety features such as anti-lock brakes and airbags.

After an At-Fault Accident

If you are involved in a car accident and found to be at fault, your insurance rates may increase significantly. This is because insurers consider drivers who have been in accidents to be at higher risk.

However, there are ways to minimize the impact of an at-fault accident on your insurance rates. For example:

• Consider raising your deductible: A higher deductible will lower your monthly premiums.

• Shop around for quotes: Different insurers may offer different rates after an accident.

• Maintain a clean driving record: Drivers who maintain a clean driving record following an accident may see their rates gradually decrease over time.

Find the Best Car Insurance Rates and Quotes by Comparing Multiple Options

Why Compare Multiple Options for Car Insurance?

Car insurance is a necessary expense that can often feel overwhelming. With so many options and providers available, it can be challenging to know where to start. However, comparing multiple options is crucial.

By comparing multiple options, you can find personalized rates based on your zip code and car details. You’ll also be able to find affordable rates that match your budget and coverage needs. This ensures that you’re not paying too much for coverage while still getting the protection you need.

How to Get Personalized Rates?

To get personalized rates for car insurance, start by gathering information about your vehicle and driving history. This includes details like your car’s make and model, year of manufacture, safety features, mileage, and more.

Once you have this information, use an online comparison tool or contact multiple providers directly to get quotes based on your specific details. Be sure to provide accurate information as any discrepancies could lead to inaccurate quotes.

Finding Affordable Rates That Match Your Budget

When shopping for car insurance, it’s essential to consider both cost and coverage. While cheap car insurance may seem appealing at first glance, it’s important not to compromise on quality in exchange for lower rates.

One way to find affordable rates that match your budget is by considering different levels of coverage. Liability-only policies are typically less expensive than full-coverage plans but offer less protection overall. Bundling policies such as auto and home insurance with the same provider can often result in discounted rates.

Choosing the Option That Offers Cheap Car Insurance Without Compromising on Quality

When choosing a car for cheap insurance without compromising on quality, there are several factors to consider beyond just price alone. Look into each provider’s reputation for customer service and claims handling as well as their financial stability.

Consider the level of coverage each provider offers and whether it meets your needs. Some providers may offer additional perks such as roadside assistance or accident forgiveness that could be worth paying slightly higher rates for.

Conclusion

Comparing car insurance rates is an important step in finding the best coverage for your needs. By gathering personal information, comparing rates by state, company, and coverage type, choosing deductibles and reviewing liability limits, and exploring options for senior drivers, teen drivers, and after an at-fault accident, you can make an informed decision about your car insurance policy. It’s also essential to compare multiple options to find the best rates and quotes available. To get started with comparing comparable car insurance rates today, gather your personal information and explore different options online. Remember to choose a policy that fits your budget while providing the coverage you need.

Frequently Linked Pages

1. Insurance The Car: A Beginner’s Guide to Unravelling the Complexities of Car Insurance

2. Car For Cheap Insurance: What to Look for in a Cheap Car Insurance Policy

3. Insurance Car How Much: Understanding the cost of Car Insurance

4. Insurance on Motorcycle: Get Free Motorcycle Insurance Quotes

Frequently Asked Questions

1. What factors affect my car insurance rate?

Your car insurance rate is affected by several factors including your age, driving record, location, vehicle type, credit score, and coverage needs.

2. How do I compare car insurance quotes?

You can compare car insurance quotes by using online comparison tools or contacting individual companies for quotes. Be sure to compare rates by state, company, and coverage type to find the best option for you.

3. What should I consider when choosing a deductible?

When choosing a deductible amount for your policy, consider how much you can afford to pay out of pocket in case of an accident or claim. A higher deductible

amount for your policy, consider how much you can afford to pay out of pocket in case of an accident or claim. A higher deductible may lower your monthly premium but could result in higher costs if you need to file a claim.

4. How do I review my liability limits?

Reviewing liability limits involves understanding how much coverage you have in case of bodily injury or property damage caused by an accident where you are at fault. Consider increasing your liability limits if you have significant assets that could be at risk in case of a lawsuit.

5. Can my credit score affect my car insurance rate?

Yes. Your credit score can impact your car insurance rate as it is often used as a factor in determining risk assessment for insurers.

6. Are there discounts available for senior drivers or teen drivers?

Yes. Many car insurance companies offer discounts for senior drivers or teen drivers who complete safe driving courses or maintain good grades in school.

7. What should I do after an at-fault accident?

After an at-fault accident, contact your insurance company to report the incident and file a claim. Your rates may increase as a result, but it’s important to have the necessary coverage in case of future accidents.

By answering these FAQs, we hope to provide you with the information you need to make informed decisions about your car insurance policy. Remember to compare rates and coverage options regularly to ensure you have the best policy for your needs.