Introduction

Are you a motorcycle rider looking for the right insurance policy? Look no further. Motorcycle insurance is an essential part of owning a bike and hitting the road. It covers both the rider and the bike in case of an accident, ensuring that you have adequate coverage when you need it most. If you have a car insured with Allstate, you may qualify for a multi-policy discount on your motorcycle insurance. With the right agent and information at your fingertips, getting the right policy for your cycle is easy. So what are you waiting for? Protect yourself and your bike today with proper motorcycle insurance from Allstate. Keep reading to learn more about how to get insured on your motorcycle.

Understanding the Importance of Insurance on Motorcycle

Riding a Harley motorcycle is an exhilarating experience, but it comes with certain risks. Motorcycles are more vulnerable to accidents and theft than cars, making insurance coverage from Allstate essential for protecting yourself, your passenger, and others on the road. Don’t forget to make your payment on time to ensure continuous coverage.

Why Motorcycle Insurance is So Important

Motorcycle insurance, including Harley, provides financial protection in case of an accident or theft. Without proper coverage from Allstate or your agent, you could be left paying for damages out of pocket. Liability insurance is required by law in most states to cover damages to other people’s property or injuries they sustain in an accident that you cause, even if it involves a car.

Do I Need Insurance on My Motorcycle?

Yes, you need insurance on your Harley motorcycle. As mentioned earlier, liability insurance is required by law in most states. Even if it’s not required where you live, having comprehensive and collision coverage from Allstate or Geico can protect your investment in case of theft or damage from accidents. Contact an agent for more information.

Is Insurance on a Motorcycle Expensive?

The cost of motorcycle insurance varies depending on several factors such as age, driving record, location, type of bike, and coverage level. However, choosing the right policy for your needs can save you money in the long run. If you own a Harley, consider getting a quote from Geico, Allstate or State Farm agent to compare prices.

Here are some tips for finding affordable motorcycle insurance:

• Shop around for motorcycle policy: Get quotes from Allstate and Geico to compare prices and see if you qualify for motorcycle insurance discounts.

• Consider raising your motorcycle policy deductible with Davidson insurance: A higher deductible means lower monthly premiums and potential Geico motorcycle insurance discounts.

• Take a safety course: Completing a safety course can sometimes lead to discounts with Geico, State Farm agent, Davidson Insurance, and Allstate.

• Bundle policies: If you already have car or home insurance with Geico, Allstate, or Farm that offers motorcycle coverage too, bundling policies can lead to savings.

Factors Affecting Motorcycle Insurance Costs

Motorcycle insurance can be expensive, and the cost of coverage varies from person to person. There are several factors that affect motorcycle insurance costs, including the option to get coverage from Geico.

Age, Driving Record, and Location

Your age, driving record, and location are some of the primary factors that determine your motorcycle insurance rates. If you’re a young rider or have a history of accidents or traffic violations, you may be considered a higher risk by insurance companies. Similarly, if you live in an area with high crime rates or heavy traffic congestion, your rates may be higher. Geico is one of the top insurance companies that takes these factors into consideration when calculating your motorcycle insurance rates.

Type of Motorcycle

The type of motorcycle you ride also plays a role in determining your Geico insurance costs. Generally speaking, more powerful motorcycles with larger engines will cost more to insure than smaller bikes. Sport bikes tend to be more expensive to insure than cruisers or touring bikes.

Value and Safety Features

The value of your motorcycle is another factor that affects your Geico insurance rates. More expensive bikes will generally cost more to insure since they would require greater repair/replacement costs in case of damage or theft. On the other hand, having safety features such as anti-lock brakes (ABS), airbags for riders/passengers can help lower your Geico premiums as it reduces the risk associated with riding.

Frequency of Use and Storage Location

Insurance companies, such as Geico, may also consider how often you use your motorcycle and where it is stored when calculating your rates. For instance, if you only ride occasionally on weekends versus someone who commutes daily on their bike would have different risks associated with riding which could lead to different premium amounts.

Other Factors

There are several other factors that could impact the cost of insuring a motorcycle such as whether you choose to insure with Geico.

1. Deductible amount: A higher deductible means lower monthly payments but potentially higher out-of-pocket expenses.

2. Coverage limits: Higher coverage limits offer greater protection, but they also come with higher premiums.

3. Credit score: Some insurance companies consider your credit score when determining your rates.

4. Discounts: You may be eligible for discounts based on factors such as completing a motorcycle safety course or bundling multiple policies (home and auto) with the same insurer.

Types of Coverage Available for Motorcycle Insurance

If you own a motorcycle, it is essential to have motorcycle insurance. Motorcycle coverage offers protection in case of accidents, damages, and theft. Insurance coverage can help you avoid the financial burden that comes with repairs or replacement costs. There are different types of coverages available for motorcycle insurance.

1. Liability Coverage

Liability coverage is mandatory in most states. It covers the cost of damages or injuries that you may cause to other people while riding your motorcycle. If you are at fault in an accident, liability coverage will pay for the medical bills, property damage, and legal fees incurred by the other party involved in the accident. Liability coverage does not cover your expenses; it only covers third-party expenses.

2. Comprehensive Coverage

Comprehensive coverage is optional but recommended for those who want maximum protection for their motorcycles. Comprehensive coverage pays for damages caused by events such as theft, vandalism, fire, weather-related incidents like hailstorms or floods, and animal collisions. This type of insurance also covers expenses related to natural disasters like earthquakes and hurricanes.

Different Types of Coverages Available for Motorcycle Insurance

Apart from liability and comprehensive coverages mentioned above, there are other types of coverages available for motorcycle insurance:

1. Collision Coverage: This type of insurance covers damages caused by collisions with another vehicle or object.

2. Uninsured/Underinsured Motorist Coverage: This type provides protection if an uninsured or underinsured driver causes an accident.

3. Medical Payments: This type pays medical bills if you get injured while riding your motorcycle.

4. Roadside Assistance: This type provides assistance if your bike breaks down on the road.

What We Cover?

Full coverage insurance on a motorcycle typically includes liability, collision and comprehensive coverages together with additional options such as uninsured/underinsured motorist coverage and roadside assistance.

When deciding which policy to choose, consider your budget and the level of protection you need. Comprehensive coverage is more expensive than liability coverage, but it provides more protection for your motorcycle. Similarly, collision coverage is more expensive than liability coverage but covers damages caused by accidents.

Getting a Free Quote for Motorcycle Insurance

Getting insurance on motorcycle is an essential step to ensure that you are protected in case of an accident or theft. However, choosing the right insurance policy can be confusing and overwhelming. One way to make it easier is by getting a free quote from various providers, including Allstate and State Farm agents.

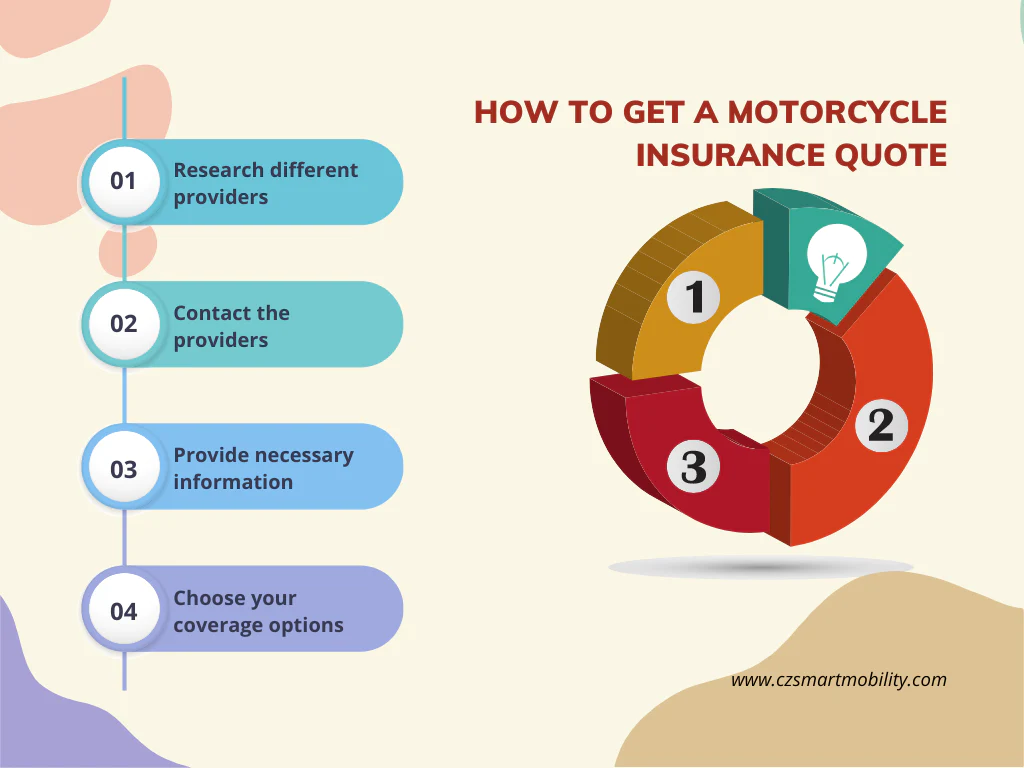

How to Get a Motorcycle Insurance Quote

Getting a motorcycle insurance quote is easy and free. Here are the steps to follow:

1. Research different providers: Look for reputable insurance companies that offer motorcycle coverage in your area.

2. Contact the providers: You can call or visit their website to request a quote.

3. Provide necessary information: The provider will ask you for some basic information about yourself and your motorcycle, such as its make, model, year, and mileage.

4. Choose your coverage options: The provider will give you options for coverage limits, deductibles, and additional features like roadside assistance or rental reimbursement.

Benefits of Getting a Motorcycle Insurance Quote

Obtaining a motorcycle insurance quote can help you in several ways:

• Comparison shopping: By getting quotes from different providers, you can compare coverage options and find the best policy for your needs.

• Cost savings: You may be able to find cheaper rates by shopping around.

• Customized coverage: Providers will offer different levels of coverage options so that you can tailor your policy to fit your specific needs.

• Peace of mind: Knowing that you have adequate insurance protection in place gives you peace of mind while riding on the road.

Where to Get Motorcycle Insurance?

There are several places where you can get motorcycle insurance:

• Directly from an insurer’s website or local office

• Through independent agents who represent multiple insurers

• Online comparison sites that allow you to compare quotes from multiple providers

When choosing a provider, make sure they are reputable and have a good track record of customer service. You can check online reviews and ratings to help you make an informed decision.

How Much Does Motorcycle Insurance Cost?

The cost of motorcycle insurance depends on several factors, including:

• Your age and driving experience

• The make, model, and year of your motorcycle

• Your location

• Your driving record

• The level of coverage you choose

On average, motorcycle insurance costs between $200 and $500 per year for liability-only coverage. However, full coverage can cost up to $1,000 or more per year.

Where to Find Cheap Motorcycle Insurance?

Finding cheap motorcycle insurance requires some effort on your part. Here are some tips:

Shop around: Get quotes from multiple providers to find the best rates.

Bundle policies: Some insurers offer discounts if you bundle your motorcycle policy with other types of insurance like auto or home.

Take a safety course: Completing a safety course can result in lower rates.

Increase your deductible: Opting for a higher deductible can lower your monthly premiums.

Cost-Conscious Rider Tips for Insurance On Motorcycle

Motorcycle insurance is a necessary expense for riders, but it doesn’t have to break the bank. By taking a few cost-conscious steps, riders can save on their motorcycle insurance expenses without sacrificing coverage.

Tips for cost-conscious riders to save on motorcycle insurance expenses

1. Shop around: The first step in finding affordable motorcycle insurance is shopping around and comparing rates from different providers. It’s important to look beyond just the premium price and consider factors like coverage limits, deductibles, and discounts.

2. Choose a higher deductible: Opting for a higher deductible can lower the overall cost of motorcycle insurance premiums. However, it’s important to ensure that the chosen deductible amount is still affordable in case of an accident.

3. Bundle policies: Many insurance providers offer multi-policy discounts when bundling multiple types of coverage together. Consider bundling motorcycle insurance with other policies, such as homeowners or auto insurance.

4. Take safety courses: Completing a safety course can not only make riders safer on the road but also qualify them for discounts on their motorcycle insurance premiums.

5. Maintain good driving records: Safe riding habits are not only essential for personal safety but also help maintain low insurance rates over time by avoiding accidents and citations.

Geico’s roadside assistance program can help riders save on costs

Geico offers a unique roadside assistance program specifically designed for motorcycles that can help riders save money on repairs and towing costs in case of breakdowns or accidents while out riding. This program is available as an add-on to Geico’s standard motorcycle insurance policy.

Choosing the right bike style can impact overall cost

The type of bike being insured will play a significant role in determining the overall cost of motorcycle insurance premiums. Generally speaking, cruisers tend to be less expensive to insure than sportbikes due to their lower speeds and less aggressive riding styles.

Managing Your Motorcycle Insurance Policy With Ease

If you own a motorcycle, having insurance coverage is essential. However, managing your motorcycle insurance policy can be confusing and time-consuming. Fortunately, there are ways to make it easier.

Geico mobile app makes managing your motorcycle insurance policy easy

One way to simplify the process of managing your motorcycle insurance policy is by using the Geico mobile app. The app allows you to view your policy, pay your bill, and even file a claim from anywhere at any time. You can also set up automatic payments or reminders so that you never miss a payment or renewal date again.

The Geico mobile app also provides access to customer service representatives who can answer any questions you may have about your policy or coverage options. With this level of convenience and service, managing your motorcycle insurance policy has never been easier.

Custom parts coverage options for your motorcycle policy

Another way to manage your motorcycle insurance policy is by selecting custom parts coverage options that fit your needs. Many companies offer this type of coverage which protects any upgrades or modifications made to the vehicle beyond the standard factory components.

Custom parts coverage may include items such as aftermarket exhaust systems, suspension upgrades, custom paint jobs, and more. This type of protection ensures that if something happens to these expensive additions on your bike during an accident or theft event, they will be covered by the insurer.

Good driving record can help you save money on your motorcycle insurance policy

Having a good driving record is another way to manage your motorcycle insurance policy with ease while saving money in the process. Insurance companies often provide discounts for safe drivers who have not had any accidents or violations in recent years.

By maintaining a clean driving record over time, you can reduce what you pay for premiums significantly. Some insurers may also offer additional discounts for completing safety courses or installing anti-theft devices on the bike.

Shop around for better rates and policies

Shopping around for better rates and policies is another way to manage your motorcycle insurance policy. Different companies offer different levels of coverage at varying prices, so it’s essential to compare options before making a final decision.

When shopping around, consider factors such as the company’s reputation, experience in the industry, and customer service ratings. You should also look for discounts or promotions that may be available for new customers or those who bundle multiple types of insurance policies together.

Conclusion

Having insurance on your motorcycle is crucial for protecting yourself and your bike in case of an accident or theft. To get the best deal on motorcycle insurance, consider getting a free quote from multiple providers and taking advantage of any discounts you may qualify for. There are cost-conscious rider tips that can help you save money on your premiums. Overall, investing in motorcycle insurance is a smart decision for any rider who wants peace of mind while on the road. Don’t wait until it’s too late to get covered!

Frequently Linked Pages

1. Comparable Car Insurance 2023: Finding the Best Policy for Your Pocket

2. Insurance Car How Much: Understanding the cost of Car Insurance

Frequently Asked Questions

1. Do I need motorcycle insurance?

Yes, it is required by law in most states to have at least liability coverage for your motorcycle.

2. What factors affect my motorcycle insurance costs?

Factors such as age, driving history, type of bike, location, and level of coverage all play a role in determining your premiums.

3. What types of coverage are available for motorcycle insurance?

Common types include liability coverage (required by law), collision coverage (for damage to your bike), comprehensive coverage (for non-accident related incidents), and uninsured/underinsured motorist coverage (in case you’re hit by someone without enough insurance).

4. How can I get a free quote for motorcycle insurance?

Most insurers offer online quotes or allow you to speak with an agent over the phone.

5. Are there ways to save money on my motorcycle insurance premiums?

Yes! Consider taking a safety course, bundling your insurance with other policies, choosing a higher deductible, and asking about available discounts such as for safe driving or being a member of certain organizations.