Introduction

Are you searching for insurance near me car? Look no further! Insurers are just a few clicks away. Whether you’re driving a new or used car, it’s important to have the right coverage to protect yourself financially from costly damages and injuries. Liability, collision, and comprehensive coverage are all available options for cars. Liability insurance covers damages or injuries that you may cause to others while driving your car. Collision insurance covers damages to your own car if you collide with another vehicle or object. Comprehensive insurance provides coverage for damages caused by events such as theft, vandalism, or natural disasters. You can find insurers online and compare prices to ensure savings on your policy. Don’t let the cost deter you from getting the necessary coverage – the peace of mind is worth it in case of an accident.

Insurance Near Me Car Options

If you own a car, having car insurance from reputable insurers is essential. It protects you financially in case of an accident or theft and ensures that your cars are covered. But with so many options available, it can be overwhelming to choose the right one for you. Comparing prices can help you find the best deal and even lead to savings in the long run.

Types of Car Insurance Coverage

Car insurance coverage varies depending on the type of car you own and your personal needs. Insurers offer policy service options that cater to different types of cars, allowing you to choose the coverage that best suits your needs while providing savings. Here are some common types of coverage:

1. Liability Coverage: This is a mandatory part of your auto insurance policy in most states and is provided by insurers. It covers damages and injuries that you may cause to others while driving your car, including accident forgiveness for certain incidents.

2. Collision coverage is an essential part of your auto insurance policy, protecting your cars from damages caused by accidents. Insurers offer this coverage to ensure that you are financially secure in case of any mishap. With just a few clicks, you can easily add this coverage to your policy.

3. Comprehensive Coverage: This insurance policy covers damages to your cars caused by non-collision events such as theft, vandalism, fire, or natural disasters. Many insurers offer accident forgiveness as an added benefit.

4. Personal Injury Protection (PIP) is one of the car insurance coverages that can be included in your insurance policy. Insurers offer this coverage to cover medical expenses for you and your passengers if you are injured in an accident. Make sure to include PIP when getting a car insurance quote.

5. Uninsured/Underinsured Motorist Coverage: This progressive coverage offered by insurers covers damages caused by another driver who doesn’t have enough or any insurance, with accident forgiveness included.

Getting a Car Insurance Quote

There are two ways to get a car insurance quote – online or through an agent. Many insurers, such as Progressive, offer accident forgiveness.

1. Online Quote: Progressive, one of the leading insurance companies in CA, offers online quotes that only take a few minutes to complete. You’ll need to provide information about yourself and your vehicle, such as make and model, year of manufacture, mileage, etc., before receiving a quote. Plus, with their accident forgiveness program, you can have peace of mind knowing that your rates won’t go up just because of one accident.

2. Agent Quote: If you prefer talking to someone in person, you can visit a Progressive insurance agent’s office near you for a quote. An agent can help explain different options, discounts available based on your personal situation, and accident forgiveness.

Finding Cheap Car Insurance Near Me

Finding affordable car insurance near me requires doing research and comparing quotes from different providers, including Progressive. Here are some tips:

• Shop around: Get quotes from multiple insurance companies, including Progressive, to compare prices and coverage options in CA.

• Increase your deductible: A higher deductible can lower your monthly premium for car insurance coverages, but you’ll have to pay more out of pocket if you get into an accident. Contact a geico insurance agency partner for a car insurance quote today.

• Bundle policies: Many insurance companies offer discounts if you bundle car and home insurance policies.

• Maintain a good driving record: Insurance companies often offer lower rates for drivers with a clean driving record.

• Ask about discounts: Some insurance companies offer discounts for things like safe driving, being a student, or having certain safety features in your car.

Benefits of Choosing a Reputable and Trustworthy Insurance Company

Better Protection for Your Car

One of the most significant benefits of choosing a reputable and trustworthy insurance company is that you get better protection for your car. Such companies offer comprehensive coverage, which includes damage caused by collisions, theft, natural disasters, and other unforeseen events. They also provide additional coverage options such as roadside assistance, rental reimbursement, and gap insurance.

Moreover, reputable car insurance providers have a reputation to uphold when it comes to car insurance coverages. They strive to maintain their high standards and keep their customers happy by providing quality services such as a fair car insurance quote. Therefore, they are more likely to settle claims quickly and fairly without any hassle.

Excellent Customer Service

Another advantage of selecting a reputable insurance company is the excellent customer service they provide. When you need help with your policy or have questions about coverage options, insurers with good reputations will be there for you. You can contact them through various means like phone calls or online chat support.

Reputable insurers, who offer various car insurance coverages, understand the importance of customer satisfaction in building long-term relationships. Hence, they invest in training their staff to handle different situations professionally and courteously, whether it’s a car insurance quote or a claim.

Reliable Representative Assistance

In case of an accident or emergency on the road, having a reliable representative from your insurance company can make all the difference. A trustworthy insurer will assign you a dedicated representative who will guide you through every step of the process.

Your representative will explain what happens next after filing an accident claim. They will also assist in coordinating repairs or arranging for alternative transportation if needed.

Peace of Mind

Choosing a reputable and trustworthy insurance company gives you peace of mind knowing that you are protected against unforeseen events that may cause financial loss or stress. With good coverage comes less worry about unexpected expenses that could put your finances at risk.

Knowing that your insurer has got your back when things go wrong gives you confidence that everything will be okay eventually.

Free Auto Insurance Quotes – Save Time and Money

Car insurance is a necessary expense for any driver, but it doesn’t have to break the bank. In fact, you can save money on your car insurance by getting free quotes from different providers. Not only does this help you find the best deal possible, but it also saves you time and hassle.

Discounts for Safe Drivers

Many car insurance providers offer discounts for safe drivers with no accidents in recent years. This means that if you’ve been driving safely and haven’t had any accidents or traffic violations, you could be eligible for a discount on your car insurance premiums. It’s important to ask about these discounts when getting a quote from an insurance provider.

Quick and Easy Quotes with Phone Apps

Getting a quote for insurance car has never been easier thanks to phone apps offered by many insurance companies. With just a few taps on your phone, you can get a quote in minutes without ever having to leave your house. These apps are designed to be user-friendly and make the process of getting car insurance as simple as possible.

Savings Vary Depending on Driving Record and Coverage Needs

The amount of savings you can get on your car insurance will vary depending on several factors such as your driving record, age, location, and coverage needs. For example, if you have a clean driving record and only need basic liability coverage, your savings may be significant compared to someone who has multiple accidents or needs comprehensive coverage.

Discounts Available Even If Accident is Your Fault

Even if an accident is your fault, you may still be eligible for discounts on your car insurance premiums. Some providers offer accident forgiveness programs that allow drivers with at-fault accidents to maintain their current rates instead of seeing an increase in premiums.

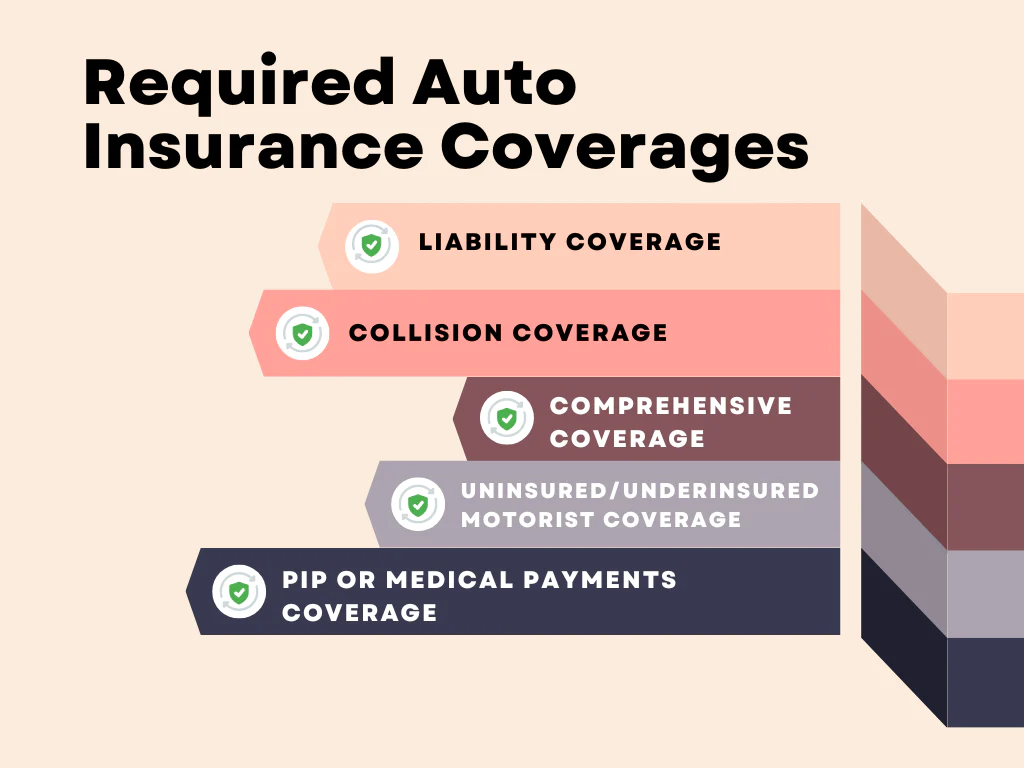

Required Auto Insurance Coverages

There are several coverages you may need to consider. Some of these coverages are required by law, while others are optional but can provide added protection for your vehicle.

Liability Coverage

Liability coverage is one of the most important types of car insurance coverage and is required in almost every state. This type of coverage helps pay for damages or injuries that you may cause to other people or their property while driving your car. It includes two types of coverage: bodily injury liability and property damage liability.

Bodily injury liability covers medical expenses, lost wages, pain and suffering, and other costs associated with injuries sustained by others in an accident where you were at fault. Property damage liability covers repairs or replacement costs if you damage someone else’s property with your car.

Collision Coverage

Collision coverage is not required by law but may be required by your lender if you have a loan on your vehicle. This type of coverage helps pay for damages to your own vehicle if it collides with another object or overturns.

If you have a new or expensive vehicle that would be costly to repair or replace, collision coverage can provide peace of mind knowing that you’re protected in case of an accident.

Comprehensive Coverage

Comprehensive coverage is optional but can provide added protection for your vehicle against non-collision incidents such as theft, vandalism, fire, natural disasters, and more. If something happens to your car that isn’t covered by collision insurance, comprehensive insurance can help cover the cost of repairs or replacement.

If you live in an area prone to natural disasters like hurricanes or tornadoes, comprehensive coverage may be particularly important for protecting your vehicle from wind and hail damage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is required in some states and highly recommended in others. This type of coverage helps protect you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages.

If you’re hit by an uninsured or underinsured driver, this coverage can help pay for your medical expenses, lost wages, and other costs associated with the accident.

Personal Injury Protection (PIP) or Medical Payments Coverage

Personal injury protection (PIP) or medical payments coverage may be required in no-fault states. PIP covers medical expenses and lost wages for you and your passengers regardless of who was at fault in the accident.

Medical payments coverage is similar to PIP but only covers medical expenses. If you don’t have health insurance or have high deductibles, this type of coverage can help cover your medical bills after an accident.

Whose insurance pays for rental car?

If you need a rental car after an accident, it’s important to know whose insurance will cover the cost. Typically, if you have collision coverage on your policy, it will also cover the cost of renting a car while yours is being repaired.

Personalize Your Car Insurance with Additional Coverages

Understanding the Terms and Conditions of Your Policy

Car insurance policies can be complex, and it is essential to understand the details and terms of your policy to know its limitations. Before purchasing a car insurance policy, make sure you read through all the terms and conditions carefully. If there are things that you do not understand, ask your insurance agent or broker for clarification. Some common terms used in car insurance policies include:

• Deductible: This is the amount you pay out of pocket before your insurance coverage kicks in.

• Premium: This is the amount you pay for your car insurance coverage.

• Limits: These are the maximum amounts your insurer will pay out for damages or injuries sustained in an accident.

Changes in Credit Score Can Affect Your Insurance Rates and Coverage

Your credit score can have a significant impact on your car insurance rates and coverage. Insurance companies use credit scores to determine how likely you are to file a claim. If you have a low credit score, you may be seen as a higher risk, which could result in higher premiums or limited coverage options.

It is important to monitor your credit score regularly and take steps to improve it if necessary. Paying bills on time, reducing debt, and avoiding opening too many new accounts can all help improve your credit score over time.

Additional Coverages Can Protect You from Property Damages and Injuries

There are several additional coverages that you can add to your car insurance policy to protect yourself from property damages and injuries. Some common options include:

Collision Coverage: This covers damages to your vehicle caused by an accident with another vehicle or object.

Comprehensive Coverage: This covers damages caused by events such as theft, vandalism, or natural disasters.

Liability Coverage: This covers damages or injuries that you cause to other people while driving.

Adding these additional coverages can provide extra protection in case of an accident or other unexpected event.

Customizing Your Policy to Fit Your Specific Situations and Needs

There are different ways to customize your car insurance policy to fit your specific situations and needs. Some options include:

Increasing Coverage Limits: If you have valuable assets that you want to protect, you may want to consider increasing your coverage limits.

Adding Additional Drivers: If you frequently lend your car to friends or family members, adding them as additional drivers can provide peace of mind.

Choosing a Higher Deductible: Choosing a higher deductible can lower your premiums but also means that you will pay more out of pocket if you need to file a claim.

Customizing your policy ensures that it fits your budget and provides the right amount of coverage for your needs.

Additional Auto and Vehicle Insurance Options

There are several options available to vehicle owners. In addition to the standard coverage provided by most policies, insurance companies offer additional services that can help drivers feel more secure on the road. Here are some of the most common additional options for auto and vehicle insurance policies.

Accident Forgiveness

Accidents happen, and if you’re involved in a collision, your insurance rates may increase as a result. However, with accident forgiveness coverage, your rates won’t go up after your first at-fault accident. This option is usually only available to drivers who have been accident-free for a certain number of years before purchasing their policy.

While this option can be costly, it’s worth considering if you’re worried about the financial impact of an accident on your insurance premiums. Some insurers offer this coverage for free or as part of a loyalty program.

Rental Coverage

If you rely on your car for daily transportation, being without it can be a major inconvenience. That’s where rental coverage comes in – it provides reimbursement for rental car expenses while your vehicle is being repaired after an accident or other covered event.

This type of policy service option can give you peace of mind knowing that you’ll still have access to transportation even if your car is out of commission. Be sure to check with your insurer about any restrictions or limitations on rental coverage before adding it to your policy.

Flexible Payment Amounts

Car insurance policies typically require monthly payments that remain consistent throughout the term of the policy. However, some insurers offer flexible payment amounts that allow drivers to adjust their payments based on their budget and changing financial circumstances.

This option can be particularly helpful for those who experience fluctuations in income or unexpected expenses throughout the year. It’s important to note that opting for lower payments may result in higher overall costs over time due to interest charges and fees.

Geico – A Trusted Choice for Auto Insurance

Why Choose Geico for Your Auto Insurance?

Car insurance is a necessity, and finding the right provider can be overwhelming. With so many options available, it’s essential to choose a company that you can trust. Geico has been providing auto insurance to drivers across the United States for over 80 years and has become a trusted choice in the industry.

One of the reasons why people choose Geico is because of its extensive network of agents. With over 16,000 agents across all states, including California (CA), Pennsylvania (PA), and others, finding an agent near you is easy. These agents are licensed professionals who can help you navigate through your policy options and find one that suits your needs.

Another reason why Geico stands out is its partnership with Progressive as a licensed insurance agency partner. This partnership means that customers can easily compare rates between these two companies and get the best deal possible.

In April 2021, J.D. Power released its U.S Auto Insurance Study, where Geico received the highest score for overall customer satisfaction among auto insurers in California. This recognition shows that Geico values its customers’ feedback and strives to provide excellent service.

Geico also offers online bill pay and claims reporting services, making it easy for people to manage their policies from anywhere at any time. Customers can make payments or file claims with just a few clicks on their website or mobile app.

Why Choose Geico for Car Insurance?

Geico offers several benefits to car owners looking for reliable insurance coverage:

Affordable Rates: One of the biggest advantages of choosing Geico is its affordable rates compared to other providers.

Discounts: Geico offers various discounts such as multi-policy discounts, good driver discounts, military discounts, student discounts, etc., which allows you to save more money.

Flexible Payment Options: You can choose from several payment options such as monthly, quarterly, or bi-annually.

Roadside Assistance: Geico offers 24/7 roadside assistance to its customers, including towing services, jump-starts, lockout services, and more.

Customizable Policies: Geico allows you to customize your policy based on your specific needs. You can choose from liability coverage, collision coverage, comprehensive coverage, and more.

Why Choose Geico?

Geico has a reputation for being a reliable and trustworthy auto insurance provider. With its extensive network of agents across all states in the US and partnership with Progressive as a licensed insurance agency partner, Geico is committed to providing excellent service to its customers.

Moreover, the company’s online bill pay and claims reporting services make it easy for people to manage their policies without any hassle. Geico offers affordable rates compared to other providers while still providing flexible payment options and customizable policies that meet your specific needs.

Conclusion

In conclusion, finding the right insurance for your car is crucial to protect yourself financially in case of accidents or damages. With various car insurance options available near you, it’s important to choose a reputable and trustworthy insurance company that can offer the required auto insurance coverages. Personalizing your car insurance with additional coverages can provide you with extra protection and peace of mind.

By taking advantage of free auto insurance quotes, you can save time and money while comparing different options. Geico is a trusted choice for auto insurance, backed by real customer reviews with a satisfaction guarantee.

To ensure you have the best coverage for your needs, consider additional auto and vehicle insurance options such as collision coverage or roadside assistance. Don’t wait until it’s too late – get insured today and drive with confidence knowing you’re protected.

Frequently Linked Pages

1. Insurance Florida Car: What You Need to Know

2. Quote for Insurance Car: The Importance of Getting a Quote for Car Insurance

FAQs

1. What types of car insurance coverages are required?

The most common required auto insurance coverages include liability coverage, which covers damages to others’ property or injuries caused by an accident you’re responsible for, and personal injury protection (PIP), which covers medical expenses for injuries sustained in an accident regardless of who is at fault.

2. How can I personalize my car insurance?

You can personalize your car insurance by adding optional coverages such as collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, rental reimbursement coverage, and roadside assistance.

3. Why should I choose a reputable and trustworthy insurance company?

Choosing a reputable and trustworthy insurance company ensures that you receive quality service when filing claims or seeking assistance. It also ensures that your claims will be handled fairly and promptly without any hidden fees or surprises.

4. Can I save money on my car insurance?

Yes! You can save money on your car insurance by comparing quotes from different companies, taking advantage of discounts such as safe driver discounts, multi-policy discounts, or bundling your insurance policies.

5. How do I get started with finding the right car insurance near me?

You can start by researching different insurance companies and comparing their rates and coverages. You can also ask for recommendations from friends and family or seek assistance from an insurance agent. Remember to choose a reputable and trustworthy company that offers the required auto insurance coverages for your needs.