Introduction

Budgeting is an essential aspect of financial planning, and it can be challenging to keep track of your expenses manually. That’s where budgeting apps come in handy! These apps offer basic budgeting features that allow you to create a budget planner and set up different categories for your expenses. With these money manager apps, you can easily manage bills, invest your money, and keep track of your monthly bills. By doing so, they can easily monitor their costs and make informed financial decisions. With the added feature of investment tracking, individuals gain better control over their expenses while investing wisely. So what exactly is a budgeting app? How does it work? And why is budgeting important? Let’s dive deeper into these questions and explore the world of finance management through mobile applications!

Tips for Choosing the Best Budgeting App

Choosing the right personal finance app or money manager can make a huge difference in your financial life. With so many investing options available, it can be overwhelming to decide which one is best suited for your needs and costs. In this section, we will discuss some tips on how to choose the best budgeting app.

1. Look for Budgeting Apps with High Consumer Ratings

One of the easiest ways to gauge whether a budgeting app or money manager is worth downloading is by checking its consumer ratings. There are many platforms where users can rate and review apps, such as Google Play Store or Apple Store. Look for apps that have high consumer ratings and positive reviews from users who have similar financial goals as you, including managing costs, investing, and using Quicken.

2. Check the Apple Store Rating of the App Before Downloading

If you’re looking for personal finance apps, it’s important to check the consumer ratings of any money manager app before downloading it. This applies to both Apple Store and Google Play. The rating system ranges from 1-5 stars, with 5 being the highest rating possible. Take some time to read through both positive and negative reviews to get a better idea of what people like and dislike about the app.

3. Consider Using an App with Touch ID Mobile Authentication for Added Security

Security should be a top priority when using personal finance apps. A good way to ensure that your money manager app keeps your hands on your data is by choosing an app that offers Touch ID mobile authentication. This feature allows you to log in using your fingerprint instead of a password, making it much harder for anyone else to access your account without permission.

4. Look for Budgeting Apps That Offer Touch ID as a Login Option

In addition to using Touch ID mobile authentication, look for budgeting apps that offer it as an optional login method. This means that if you prefer not to use fingerprints, you can still log in using a traditional username and password combination. Moreover, make sure the app allows you to link multiple accounts and track all your data in one place. Consider the cost of the app before purchasing, and check if there is a free version with unlimited number of transactions available.

5. Choose a Budgeting App That Fits Your Specific Financial Needs and Goals

Not all budgeting apps are created equal. Some may focus on helping you save money, while others may be more geared towards tracking your spending habits. Before choosing an app, determine what your specific financial needs and goals are, taking into account the cost of the app. Additionally, it’s worth checking consumer ratings to weigh the pros and cons of each app. This will help you find an app that is tailored to your unique situation.

Best Free Budgeting Apps

Are you searching for a cost-effective budgeting app that can help you manage your account finances without breaking the bank? Look no further than these top-rated free budgeting apps. However, before downloading any of them, make sure to check their ratings and cons.

1. Goodbudget

Goodbudget is one of the top-rated personal finance apps that uses the envelope budgeting method. This approach involves allocating funds to various categories, such as groceries, entertainment, and transportation, and then using cash or debit cards to pay for expenses within each category. With Goodbudget, users can create virtual envelopes and track their spending in real-time using their account. However, some cons of the app should be considered before usage.

Pros:

• Simple and easy-to-use interface

• Offers both web-based and mobile app versions

• Allows syncing across multiple devices

• Provides customizable reports to track spending habits

Cons:

• Limited features on the free version

• No automatic transaction importation

2. Mint

Mint is a widely used free money manager app that offers basic budgeting and budget categories to help users plan their finances. It automatically categorizes transactions from linked accounts, provides personalized financial advice based on spending patterns, and offers bill reminders. Additionally, Mint serves as a budget planner with its helpful budgeting features.

Pros:

• A comprehensive overview of all financial accounts in one place

• Automatic categorization of transactions

• Alerts for unusual spending activity or upcoming bills

• Offers credit score updates

Cons:

• Ads displayed within the app

• Limited investment tracking options

3. Personal Capital

Personal Capital is a free money manager app and company that offers investment tracking and retirement planning features. It links with all financial accounts including investments, loans, credit cards etc., providing an overall picture of net worth. The latest version of the app includes new features, and the number of users continues to grow.

Pros:

• Investment management tools with personalized advice from registered advisors

• A retirement planner with guidance on how much savings are required, along with the help of personal finance apps and a money manager app to keep track of your accounts. Discover the best budgeting app to manage your finances efficiently.

• Detailed analysis of portfolio performance

Cons:

• Requires linking investment accounts for full utilization.

• No option to manually input transactions

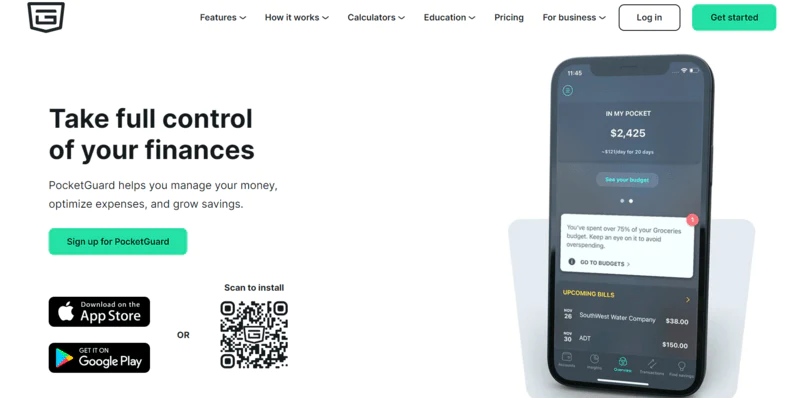

4. PocketGuard

PocketGuard is a free budget app that helps users track their spending and create a personalized budget plan. It syncs with bank accounts and credit cards to provide a real-time overview of finances. The latest version of the app has received high ratings from users. The company behind PocketGuard is dedicated to providing a user-friendly interface and reliable service. It also offers a feature called “In My Pocket,” which shows how much money is left over after bills and expenses are paid.

Pros:

• Simple and easy-to-use interface

• Provides personalized saving tips

• Offers alerts for upcoming bills or overspending

Cons:

• Limited budget categories

• No option to manually input transactions

5. EveryDollar

EveryDollar is one of the top-rated personal finance apps that follows the zero-based budgeting approach. This means every dollar earned is assigned to an expense category, with no unassigned funds remaining at the end of the month. It also offers a paid version with additional features such as bank account syncing and priority customer support, which has received high ratings from users.

Pros:

• User-friendly interface

• Customizable expense categories

• Provides visual representation of monthly spending habits

Cons:

• Limited features on free version

• No automatic transaction importation

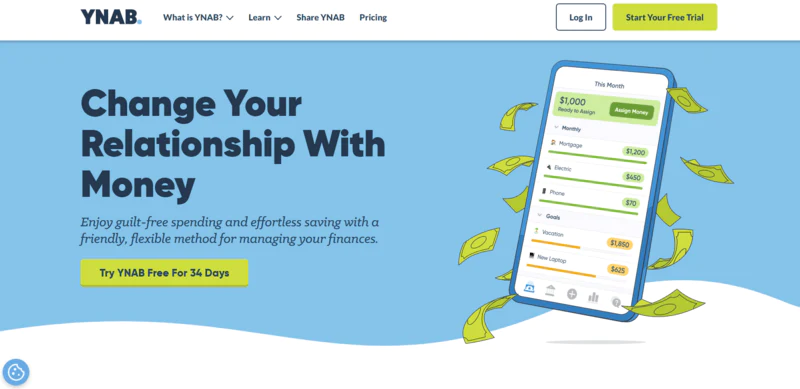

6. YNAB (You Need A Budget)

YNAB is one of the highly rated personal finance apps that offers a free trial period and a cost-free time period for college students. Its free version allows an unlimited number of accounts, making it a popular choice among users. This app encourages users to create realistic budgets based on actual income rather than projected earnings and provides tools for goal-setting, debt repayment planning, and savings tracking.

Pros:

• Encourages proactive financial planning

• Easy-to-follow tutorials for beginners

• Allows customization of spending categories

Cons:

• High learning curve compared to other apps

• Limited investment tracking options

There are multiple account options available with high ratings on both Apple Store and Google Play Store. These apps can assist you in tracking your spending habits, creating customized budgets, managing investments or retirement plans, and providing personalized financial advice. By selecting one of these top-rated free budgeting apps, you can take control of your finances without breaking the bank! Additionally, make sure to check for the latest version of the app to ensure optimal performance.

All-in-One Place: Get Your Passes, Tickets, Cards, and More with Bill Organizer & Money Saver

Managing finances can be a daunting task, especially when you have multiple bills to pay, credit cards to manage, and savings to track. However, with the Bill Organizer & Money Saver app, you can simplify your financial life and keep everything in one account. Plus, there’s a free version available with high ratings from satisfied users.

Keep track of all your bills

The Bill Organizer & Money Saver is one of the best budgeting apps that you can find in the app store. This personal finance app allows you to keep track of all your bills in one place, whether you add them manually or link them directly from your bank account. With the free version of this app, you can ensure that you never miss a bill payment again.

Set reminders for upcoming payments

With the app’s free version, you can set reminders for upcoming payments and stay on top of your account’s finances. The reminder feature ensures that you never miss a payment and avoid late fees. Check out the app’s ratings to see how other users have benefited from this feature.

Easily track bills and payments

The free version of the app makes it easy to track bills and payments across all your accounts. You can view pending payments and see which ones have been paid already. Check out the ratings to see what other users think of this helpful tool.

Manage your savings

In addition to tracking bills and payments, the app also helps you manage your savings account. You can set savings goals and monitor progress towards achieving them using the free version of the app. Additionally, you can check ratings to see how other users have rated the app’s savings management features.

Make contactless payments with ease

The free version of Bill Organizer & Money Saver, with high ratings, seamlessly integrates with popular payment methods like PayPal and Venmo. This means that you can make contactless payments with ease using the app.

Simplify your financial life

By managing everything from bills to cards to cash in one convenient location, the Bill Organizer & Money Saver simplifies your financial life. You don’t need multiple apps or logins anymore; everything is in one place. Plus, there’s a free version available and the app has high ratings from satisfied users.

Best Budgeting Apps for Overspenders

Overspending can be a real problem for many people. It’s easy to lose track of your spending, especially when you’re not keeping an eye on it. Fortunately, there are several budgeting apps available that can help even the most dedicated overspender get their finances under control. Some of these apps offer a free version, while others require a subscription. To find the best one for you, check out the ratings and reviews from other users.

Why Use a Budgeting App?

Budgeting apps, including the free version, can help you keep track of your spending and stay within your budget. They allow you to set up alerts when you’re getting close to your spending limit, so you don’t accidentally overspend. They provide insights into where your money is going, making it easier to identify areas where you might be able to cut back. Additionally, checking the ratings of these apps can help you choose the best one for your needs.

Top Budgeting Apps for Overspenders

1. Mint

Mint is one of the most popular budgeting apps available today, with a free version for users to try out. It allows users to link their bank accounts and credit cards, so all of their transactions are automatically tracked in one place. Users can set up budgets and receive alerts when they’re close to reaching their limits. Additionally, Mint has high ratings from satisfied users.

2. PocketGuard

For overspenders who need help managing their finances, PocketGuard is an excellent option. This app provides real-time updates on how much money users have left in their budget and links with their bank accounts and credit cards. Additionally, PocketGuard has a free version available for those who want to try it out first, and it has high ratings from satisfied users.

3. YNAB (You Need a Budget)

YNAB takes a slightly different approach than other budgeting apps by requiring users to manually enter all of their transactions rather than relying on automatic tracking. However, this approach has its benefits as it forces users to be more aware of their spending habits. According to ratings, YNAB is highly recommended for those who want to take control of their finances through manual tracking.

How These Apps Can Help Overspenders

By using these budgeting apps, overspenders can gain better control over their finances and avoid falling into debt. They allow users to see exactly where their money is going and make adjustments accordingly. Additionally, users can check the ratings of these apps to ensure they are reliable and effective.

For example, if someone realizes that they’re spending too much money on eating out, they can download a personal finance app from the app store with high ratings. They can set a lower budget for dining out and receive alerts when they’re getting close to their limit. This makes it easier to avoid overspending and stay within their means.

In addition to helping users stay within their budgets, these highly-rated apps also provide valuable insights into spending habits. They allow users to see how much money they’re spending on different categories like groceries, entertainment, and transportation. This information can be used to identify areas where they might be able to cut back and save money, based on the ratings of other users who have found success with the app.

Best Budgeting Apps for Couples

Managing finances as a couple can be challenging, especially when you have different spending habits and financial goals. Fortunately, there are several budgeting apps specifically designed to help couples manage their money together. In this listicle, we’ll discuss the best budgeting apps for couples based on ratings and how they can help you achieve your financial goals.

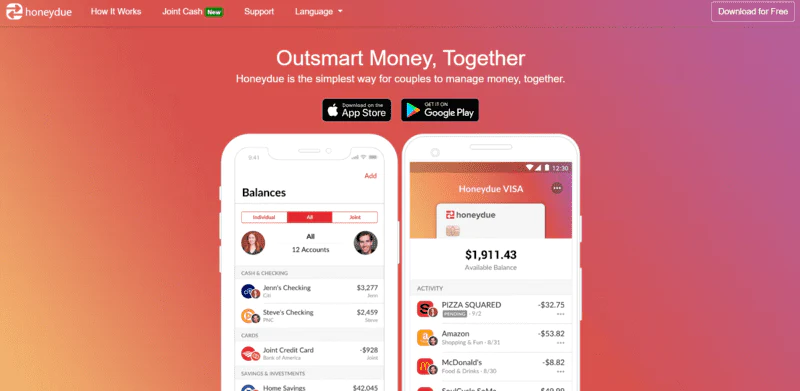

1. Honeydue

Honeydue is a popular app for couples that allows them to track their spending and bills in one place. With Honeydue, you can link your bank accounts and credit cards to the app, so you can see all your transactions in one place. You can also set up bill reminders and track your shared expenses with your partner. One unique feature of Honeydue is the ability to send “love notes” to your partner when you make a payment or complete a task. Additionally, the app has received high ratings from satisfied users.

2. Goodbudget

Goodbudget is a personal finance app that uses the envelope budgeting system to allocate funds for different expenses. With Goodbudget, you can create virtual envelopes for different categories like groceries, entertainment, and utilities. You can download this app from the app store. You then allocate a certain amount of money to each envelope based on your budget. When you spend money from an envelope, it subtracts from the total amount allocated for that category.

3. Twine

Twine is a unique app that not only helps with budgeting but also allows couples to save and invest money together. With Twine, you can set savings goals together and contribute money towards those goals automatically each month. You can also invest in personalized portfolios based on your risk tolerance and financial goals.

4. Mint

Couples can also consider using Mint, which provides personalized budgeting advice based on spending habits and financial goals. Mint allows you to link all of your accounts in one place so you can see an overview of your finances at a glance. It also provides personalized recommendations for ways to save money based on your spending habits.

Best All-in-One Budgeting and Bill Organizing Apps

Managing your finances can be a daunting task, but with the help of budgeting and bill organizing apps, it can become a breeze. In this article, we’ll take a look at some of the best all-in-one budgeting and bill organizing apps available in the app store.

Everydollar and YNAB

Everydollar and YNAB (You Need A Budget) are two of the most popular budgeting apps available in the app store. Both offer features to manage bills and upcoming bills, making it easier for you to keep track of your expenses.

Everydollar is a free app that allows you to create a monthly budget based on your income. You can also track your spending by linking your bank account or manually entering transactions. With Everydollar, you can easily see where your money is going each month.

YNAB is a paid app that costs $14.99 per month or $99 per year. It offers similar features as Everydollar but focuses more on helping users break the paycheck-to-paycheck cycle by giving every dollar a job. This means that you assign every dollar in your budget to a specific category, such as rent or groceries.

Quicken and PocketGuard Plus

Quicken is another popular app for managing account balances and monthly bills. It allows you to link all of your accounts in one place so that you can easily see your financial picture. Quicken also offers bill pay services so that you can pay all of your bills from within the app.

PocketGuard Plus is gaining popularity for its available bank sync feature, which allows users to automatically import their transactions into the app. It also offers personalized insights based on your spending habits so that you can make smarter financial decisions.

Zeta

Zeta is a newer app that has quickly risen to the top spot for its custom categories and syncing capabilities across iOS and Google Play. It allows you to create custom categories for your expenses, such as “groceries” or “entertainment.” You can also sync your accounts across devices so that you always have access to your financial information.

Choosing the Right App

With so many options available, it’s important to choose an app that fits your specific needs for managing bills and budgeting effectively. Consider factors such as cost, features, and ease of use when deciding which app is right for you.

Best Budgeting Apps for Building Wealth

If you’re looking to build wealth, one of the best things you can do is start tracking your expenses and saving money. Fortunately, there are plenty of budgeting apps available that can help you do just that. In this article, we’ll take a look at some of the best budgeting apps for building wealth and discuss how they can help you achieve your financial goals.

1. Personal Capital

Personal Capital is a popular investment service app that offers free portfolio tracking and financial planning tools to help users manage their net worth and reduce portfolio fees. With Personal Capital, you can link all of your accounts in one place and get a complete view of your finances. The app also offers investment advice based on your goals and risk tolerance.

One of the great things about Personal Capital is that it’s completely free to use. You don’t have to pay any fees or commissions to access its services. Plus, the app is available on both iOS and Android devices, so you can manage your finances from anywhere.

2. Mint

Mint is another popular budgeting app that can help you manage your money and build wealth. With Mint, you can track your expenses, create budgets, set savings goals, and even get personalized investment advice.

One of the best things about Mint is its user-friendly interface. The app makes it easy to see where your money is going each month and identify areas where you could cut back on spending. Plus, Mint offers alerts when bills are due or when you’ve exceeded a certain spending limit.

3. Acorns

Acorns is an investment app that rounds up your purchases to the nearest dollar and invests the difference for you. For example, if you buy a coffee for $2.50 with a linked debit card, Acorns will round up to $3.00 and invest $0.50 into a diversified portfolio.

Acorns also offers “Found Money” rewards, which are cash back bonuses from partnered brands that are automatically invested into your account. With Acorns, you can start investing with as little as $5 and choose from several investment portfolios based on your risk tolerance.

4. YNAB

YNAB (You Need A Budget) is a budgeting app that helps you take control of your finances by giving every dollar a job. With YNAB, you create a budget for each category of spending and assign money to those categories as it comes in.

One of the unique features of YNAB is its “Age of Money” metric, which tells you how long ago the money in your budget was earned. The goal is to have an “Age of Money” greater than 30 days, which means you’re living off last month’s income and not relying on paycheck-to-paycheck living.

5. Robinhood

Robinhood is an investment app that allows users to buy and sell stocks, ETFs, options, and cryptocurrencies without paying any commission fees. With Robinhood, you can invest in companies you believe in and potentially earn returns over time.

One thing to keep in mind with Robinhood is that it’s important to do your research before investing. While the app makes it easy to buy and sell investments, it’s up to you to make informed decisions about what companies or assets to invest in.

How Much Do Budgeting Apps Cost?

Budgeting apps have become increasingly popular over the years as people look for ways to manage their finances better. These apps come with different features and capabilities, which can help users track their spending, create budgets, and save money. However, one question that many people ask is how much do budgeting apps cost? In this section, we will explore the costs of budgeting apps and some of the best budgeting apps available in the market.

Costs of Budgeting Apps

Budgeting apps come in different price ranges, from free to paid versions. Some budgeting apps offer basic features for free, while others require a subscription fee for advanced features. The cost of budgeting apps varies depending on the platform and the provider.

Free Budgeting Apps: There are several free budgeting apps available in the market today. These include Mint, PocketGuard, Wally, and Goodbudget. Free budgeting apps typically offer basic features such as expense tracking, creating budgets, and generating reports.

Paid Budgeting Apps: Paid budgeting apps usually come with more advanced features such as investment tracking and bill payment reminders. Some examples of paid budgeting apps include You Need a Budget (YNAB), Personal Capital, Quicken Deluxe, and Mvelopes.

Key Specs to Consider

When choosing a budgeting app that suits your needs and budget, there are key specs you need to consider:

Ease of Use: A good budget app should be easy to use with an intuitive interface that allows you to navigate through it without any difficulty.

Compatibility: Ensure that your chosen app is compatible with your device’s operating system (iOS or Android).

Security Features: Look out for security features such as two-factor authentication or encryption that protect your financial data from unauthorized access.

Best Visual Budgeting Apps

Managing money can be a daunting task, but with the help of budgeting apps, it doesn’t have to be. In this article, we’ll explore some of the best visual budgeting apps available on the market.

1. Mint

Mint is a popular app that offers a comprehensive view of your finances. With its budget tracking feature, you can easily monitor your spending and stay within your limits. The app also provides bill reminders to ensure you never miss a payment and investment tracking to keep tabs on your portfolio’s performance. One of the best things about Mint is its user-friendly interface, which makes it easy to navigate and understand your financial situation.

2. PocketGuard

PocketGuard is another excellent app for managing your finances. It automatically categorizes your expenses and provides personalized budget recommendations based on your spending habits. You can set goals for saving money or paying off debt, and the app will help you track progress towards those goals. What sets PocketGuard apart from other budgeting apps is its simplicity – it’s incredibly easy to use and understand.

3. You Need a Budget (YNAB)

If you’re looking for an app that can help you break the paycheck-to-paycheck cycle and save more money, then You Need a Budget (YNAB) might be just what you need. YNAB focuses on helping users create a realistic budget that they can stick to by assigning every dollar they earn to specific categories such as rent, groceries, or entertainment. This approach helps users become more mindful of their spending habits and make better financial decisions.

4. Goodbudget

Goodbudget is a budgeting app based on the envelope system – an old-school method where users allocate funds to different categories (envelopes) and track their spending accordingly. The digital version of this system allows users to create virtual envelopes for various expenses such as groceries or transportation. Goodbudget also offers syncing across multiple devices so that you can access your budget on the go.

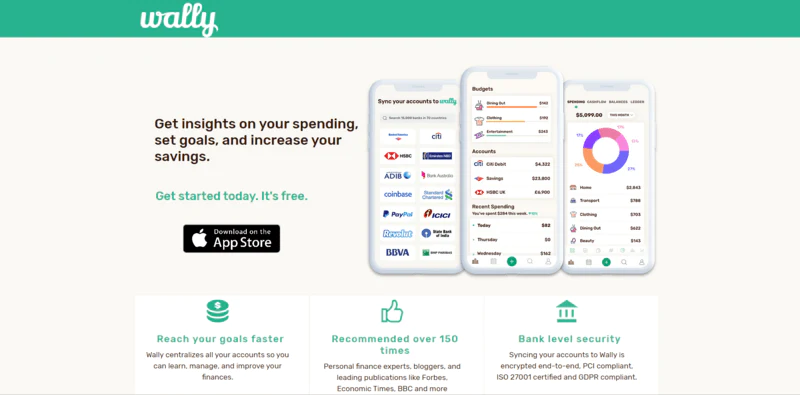

5. Wally

Wally is a free app that allows users to track their expenses by taking photos of receipts and categorizing them accordingly. The app also provides insights into spending patterns, allowing users to identify areas where they can cut back and save money. Wally’s user interface is sleek and straightforward, making it easy to use even for those who are new to budgeting apps.

6. Personal Capital

Personal Capital offers both budgeting and investment tracking features, allowing users to manage their money in one place. With Personal Capital, you can create a personalized investment plan based on your financial goals and risk tolerance. The app also provides a net worth tracker so that you can monitor your overall financial health.

Best Personal Finance Apps for Debt Payoff

If you’re struggling with debt, managing your personal finances can be overwhelming. Fortunately, there are personal finance apps available that can help you keep track of your debt payoff progress and achieve financial freedom faster. In this article, we’ll explore the best personal finance apps for debt payoff, including their features and benefits.

1. Mint

Mint is a popular personal finance app that offers a wide range of features to help you manage your money. One of its most useful features for debt payoff is the ability to set payment reminders. You can set reminders for all your bills and loans so that you never miss a payment again.

Mint also allows you to create a budget and track your spending. This feature is particularly helpful when trying to pay off debt because it helps you identify areas where you can cut back on expenses and put more money towards paying off your debts.

2. You Need a Budget (YNAB)

You Need a Budget (YNAB) is another great personal finance app for managing debt. YNAB operates on the principle of zero-based budgeting, which means every dollar has a job in your budget.

This app also offers tools to help you manage your debts more effectively. For example, it allows you to set goals for paying off specific debts and tracks your progress towards those goals. It also provides detailed reports on how much interest you’re paying on each loan or credit card balance.

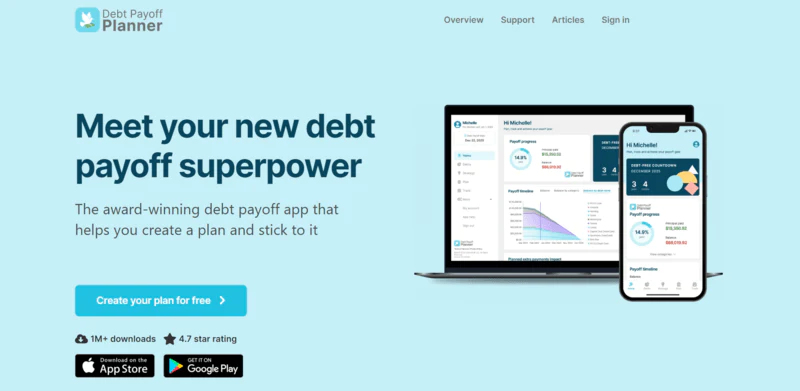

3. Debt Payoff Planner

Debt Payoff Planner is an app specifically designed to help people pay off their debts faster. It allows users to enter information about all their loans and credit cards, including balances, interest rates, minimum payments, and due dates.

Once all the information has been entered into the app, it creates a customized plan for paying off all debts as quickly as possible. The app calculates how much extra money needs to be put towards each debt each month in order to pay it off as quickly as possible.

4. Personal Capital

Personal Capital is a personal finance app that offers a range of features, including investment management, retirement planning, and budgeting tools. While it’s not specifically designed for debt payoff, its budgeting tools can be helpful when trying to pay off debts.

One of the most useful features of Personal Capital is its ability to track your net worth. This feature allows you to see how much progress you’re making towards your financial goals over time.

Final Thoughts on Using Budgeting Apps Effectively

Budgeting apps have become an essential tool for managing personal finances. They help users track their expenses, create budgets, and save money. However, not all budgeting apps are created equal. To use them effectively, users need to consider both the pros and cons mentioned in user reviews.

Importance of User Reviews

User reviews provide an accurate picture of the app’s performance. They reflect the experiences of real users and highlight the app’s strengths and weaknesses. Reading reviews can help users determine if the app is suitable for their goals.

High Ratings Indicate Usefulness

High ratings indicate that many users find the app useful. It means that the app has met their expectations and helped them manage their finances effectively. However, users should not rely solely on high ratings when choosing a budgeting app.

Cons Mentioned in Reviews Help Users Make Informed Decisions

Cons mentioned in reviews can help users make an informed decision about whether to use the app or not. For example, if several reviewers mention that the app crashes frequently or has poor customer support, it may be wise to look for a different option.

Consider Both Pros and Cons When Choosing an App

Using budgeting apps effectively requires users to consider both the pros and cons mentioned in reviews. Users should weigh each factor against their goals and priorities before making a decision.

Conclusion

Now that you have explored various budgeting apps, it’s time to choose the right one for your money management needs. Remember, not all budgeting apps are created equal. You need to find an app that suits your lifestyle and financial goals. Consider the tips we discussed earlier when choosing a budgeting app. Lastly, always use these money management tools effectively by setting realistic goals and tracking progress regularly. With discipline and commitment, these apps can help you achieve financial success.

Frequently Linked Pages

1. PO System for Small Business – The Ultimate Guide to Choosing the Best PO System for Small Business 2023

2. Expensify – Expensify: Streamline Your Expense Management Today!

Frequently Asked Questions

1. What are the benefits of using a money management app?

Using a money management app helps you track your finances, stay on top of your bills and spending, and helps you create and stick to a budget. Overall, it helps you manage your finances more efficiently and effectively.

2. Are there any free money management apps available?

Yes, there are many free money management apps available including Mint, Personal Capital, and PocketGuard.

3. How do budgeting apps help with tracking expenses?

Budgeting apps allow you to link your bank accounts and credit cards to automatically track your expenses. You can also manually enter expenses, categorize them, and set spending limits to keep you on track.

4. Can these apps help with creating a budget and sticking to it?

Absolutely. Budgeting apps help you create a budget based on your income and expenses, track your progress, and provide alerts when you overspend.

5. Do these apps come with features to monitor investments?

Some budgeting apps like Personal Capital have features to monitor investments, analyze investment performance and provide recommendations for investment strategies.

6. Are these apps safe and secure to use?

Yes, reputable budgeting apps implement robust security measures to protect your personal and financial information. They utilize encryption technology and have strict privacy policies to safeguard your data.

7. Do money management apps provide any financial advice?

Some budgeting apps like Personal Capital offer financial advisory services but this typically requires an additional fee.

8. What features should I look for in a good budgeting app?

You should look for features like automatic expense tracking, bill reminders, customizable budget categories, financial goal setting, and reliable security measures.

9. Can I sync multiple bank accounts with a budgeting app?

Yes, most budgeting apps allow you to link and sync multiple bank accounts and credit cards in one place.

10. Are these apps suitable for small businesses and freelancers?

Some budgeting apps like QuickBooks Self-Employed and FreshBooks are specifically designed for small businesses and freelancers. They provide features like invoicing, expense tracking, and tax preparation.